Launched in 1989, Digicash introduced the first cryptocurrency. In the 1990s, it was considered leading-edge payments technology. But physical and digital currencies are payment networks. In payment systems, good technology is neither sufficient nor generally the biggest hurdle. No matter how good the technology, without critical mass they’re worth little. …

Read More »A DoJ Investigation of Visa Is the Latest Chapter in a Long History of Probes Into Network Policies

The news that the U.S. Department of Justice is probing debit card routing practices at Visa Inc. follows on a long history of such investigations and could portend a more serious attitude by regulators to address longstanding merchant complaints about network routing and pricing. “This is one more heavy step …

Read More »Justice Department Investigating Visa Debit Acceptance and other Digital Transactions News briefs from 3/19/21

The U.S. Justice Department is investigating Visa Inc.’s practices regarding online and in-store debit card acceptance, according to reporting by The Wall Street Journal. The probe is centered on whether Visa has restricted merchants’ ability to flow transactions over less-costly networks, according to sources who spoke to the newspaper.Fintech Enova International said it acquired Pangea …

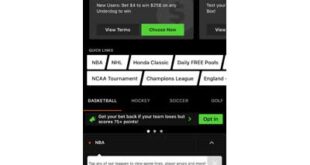

Read More »Sports Betting Offers Processors a Rapidly Growing Opportunity As States Sign on

With 21 states having legalized sports betting in one form or another, major payments processors sense a growing opportunity. The latest development comes from Virginia, where Nuvei Corp. said Wednesday a subsidiary has been granted a sports-betting vendor registration by the Virginia Lottery. “The company can now offer its innovative payment …

Read More »Priority 4Q Revenue up 8.1% and other Digital Transactions News briefs from 3/17/21

Payments provider Priority Technology Holdings Inc. reported fourth-quarter revenue of $106.1 million, up 8.1% year-over-year. Excluding Priority’s RentPayment business, which the company sold in September, revenue grew 12.3% from $94.5 million.Payments provider Flywire Corp. launched Flywire eStore, a platform that supports e-commerce for Flywire clients and their customers. The move follows Flywire’s decision last …

Read More »COMMENTARY: To the New Congress: Beware of the Durbin Amendment’s Failures

With the Covid-19 pandemic still imposing a huge financial weight on the nation’s small businesses and families, many legislators are understandably eager to pursue policies they feel will ease that burden. But lawmakers must be careful that they are looking at policies that really will help. Unfortunately, some sectors—in this …

Read More »The Architect of Debit Price Caps Attacks Visa And Mastercard for Planned Credit Card Hikes

The U.S. Senator who gave his name nearly a decade ago to a law that caps debit card interchange made it plain Thursday he now has the rates merchants pay for credit card acceptance squarely in his sights. Commenting during a meeting of the Senate Judiciary Committee, which he heads, …

Read More »BJ’s Wholesale Adds Online SNAP Payments and other Digital Transactions News briefs from 3/5/21

The warehouse-store chain BJ’s Wholesale Club said it has added electronic benefits transfer payment capability to its Web site for in-store or curbside pickup of SNAP-eligible items. The service applies to stores in Florida and North Carolina. The processor is FIS Inc.’s Worldpay. SNAP is the federal Supplemental Nutrition and Assistance Program.Independent …

Read More »Interchange Adjustments Will Add a Net $889 Million to Merchants’ Costs, an Analysis Says

With the two big payment networks set to raise by hundreds of millions of dollars the cost U.S. merchants pay for card acceptance, e-commerce merchants could see fee boosts while some segments—like travel-and-entertainment and low-ticket-value, quick-service merchants—could see some reductions. In total, rate tweaks scheduled by Visa Inc. and Mastercard …

Read More »E-Complish Teams With Plaid to Validate Accounts And Funds for ACH Transactions

In an effort to move automated clearing house transactions closer to real-time, E-Complish, a New York City-based payment processor, announced Monday it has teamed with data network Plaid Inc., to validate a bank account, and the funds in it, for ACH transactions. The service makes it possible for E-Complish customers …

Read More »