Visa Inc. closed on its acquisition of Earthport, a provider of cross-border payments services. The card network says it expects the acquisition to allow it to access “the vast majority of the world’s banked population” to allow them to move money globally. Earthport earlier this year had been the object …

Read More »ACH Q1 Volume at 6 Billion and other Digital Transactions News briefs from 5/7/19

NACHA said automated clearing house volume in the first quarter totaled 6 billion payments that included 3.5 billion debit transactions and 2.5 billion credit transactions. Internet-initiated payments increased 10.3% to 1.6 billion. Same-day ACH transactions totaled 52.7 million, up 24% from a year prior. NACHA also launched the NACHA Corporate …

Read More »Under One Roof, Nxgen And Payscape Eye Expansion And Acquisitions

Payments providers Nxgen International and Payscape have come under one roof in a deal valued at $124 million and aided by investor Parthenon Capital Partners, the companies announced late last week. That will provide the impetus for both companies, whose brands will continue, to focus on expansion through organic growth …

Read More »Integrated Payments in the U.S. and Abroad Prove Fruitful for EVO Payments

The integrated-payments phenomenon is paying off for EVO Payments Inc. in the United States and internationally. While Atlanta-based EVO reported a decrease in first-quarter earnings, its strategy of courting integrated software vendors and companies that support their point-of-sale software continues to reap rewards, which EVO management says will benefit the …

Read More »Facebook Planning a Crypto Payments System? and other Digital Transactions News briefs from 5/3/19

Facebook Inc. reportedly is planning a cryptocurrency-based payment system using a digital coin with stable value that would enable the social-networking giant to avoid fees it incurs for conventional card payments, according to a report in The Wall Street Journal cited by the Associated Press. The report says Facebook is …

Read More »Global Payments Touts Differentiated Strategy as Worldpay Reports Strong First-Quarter Results

The big merchant processors Global Payments Inc. and merger candidate Worldpay Inc. reported healthy first-quarter results Thursday. North America performed especially well for Atlanta-based Global Payments, generating $678.4 million in revenues, up 14% from $594 million in 2018’s first quarter. In contrast, European revenues slipped 0.3% to $142.9 million while …

Read More »Square’s Dorsey Not Troubled by the Acquiring Industry’s Mega-Mergers

Square Inc. has been a non-traditional merchant acquirer since its birth nearly a decade ago, and a wave of industry mergers won’t change that, according to chief executive Jack Dorsey. “I do think we will continue to see consolidation, but that doesn’t worry me,” Dorsey, who also is Twitter Inc.’s …

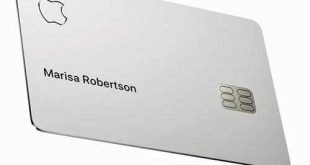

Read More »Apple Pay on Track To Hit 10 Billion Transactions in 2019

Boosted in part by transit systems and other merchants adopting contactless payments, the Apple Pay mobile-payments service had another quarter of record volume and is heading for a milestone this year, Apple Inc. chief executive Tim Cook said Tuesday. “Apple Pay transaction volume more than doubled year-over-year, and we are …

Read More »Mastercard Will Remain on the Hunt for Acquisitions and Fintech Investments, Its CEO Says

Mastercard Inc. has been active on the mergers-and-acquisitions front lately, and that’s going to continue, according to company president and chief executive Ajay Banga. The acquisitions typically involve financial-technology firms in all corners of payments. Just two weeks ago, Mastercard announced that it had acquired Vyze Inc., the provider of …

Read More »With a Hurdle Cleared, FIS Expects to Close $43 Billion Worldpay Deal in the Third Quarter

Fidelity National Information Services Inc. (FIS) on Tuesday said it expects to close its colossal $43 billion acquisition of payment processor Worldpay Inc. in the third quarter following a Federal Trade Commission ruling. The merger, announced in March, would create a processing colossus with payments services ranging from merchant processing, …

Read More »