Payments provider Citcon USA LLC said early Thursday it is unveiling plugins that will allow e-commerce platforms like Commerce Cloud, Magento, Salesforce, Shopify, WooCommerce, and others to offer merchants the ability to accept Alipay, WeChat Pay, and China UnionPay, as well as credit cards, without coding. The development represents a …

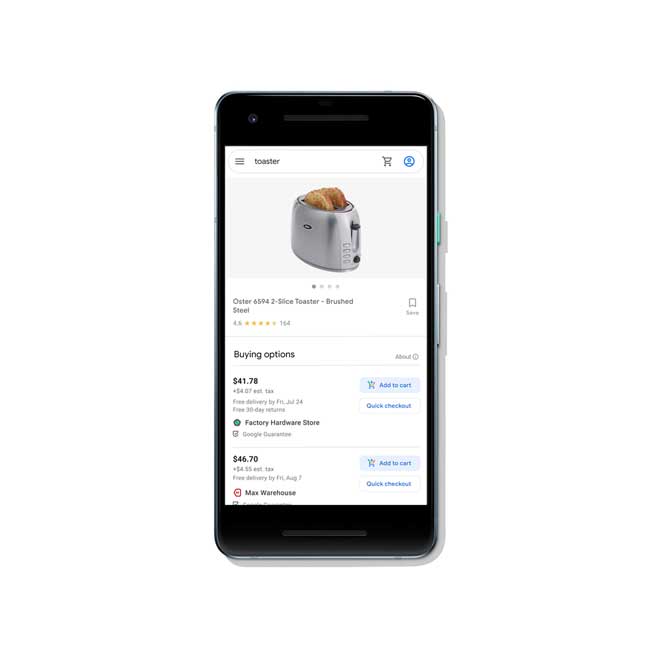

Read More »Google Announces Test With No Commissions for Sellers Using Its Shopping Platform

Expanding on an initiative it began April that offered free listings for some merchants, search-engine leader Google on Thursday announced a test that charges zero-percent commissions to online sellers when they sell a product through its Shopping Actions service. In addition, sellers can use Shopify Inc.’s payment service as well …

Read More »75% of Consumers Prefer Contactless Cards and other Digital Transactions News briefs from 7/23/20

Some 75% of U.S. cardholders prefer contactless cards to card swipe, mobile payment, inserting a chip card, and cash, according to a survey of 1,000 cardholders by card-technology specialist Entrust Datacard.Alliance Data Systems Corp., a provider of private-label card programs, reported a 27% year-over-year drop in revenue for the second quarter to …

Read More »Don’t Look for Any Near-Term Relief When It Comes to Fraud Losses, LexisNexis Risk Solutions Says

While merchants, banks, and payments providers may be tempted to blame sharply rising fraud rates on the pandemic, fraud losses were rising before Covid-19 set in and will continue to rise for as far as the eye can see, according to experts behind a major fraud report released this week. …

Read More »Shopify Pairs Up With Affirm To Offer an Installment-Payment Option for Small Businesses

The installment-payment movement has gained the big e-commerce services provider Shopify Inc. as a convert with Wednesday’s announcement that Shopify will offer a credit option to its U.S. customers through Affirm Inc. San Francisco-based Affirm, an online credit-services provider, said approved Shop Pay customers at checkout will be able to …

Read More »Synchrony’s Retailers Suffer a Blow to Purchase Volume

The hits merchants are taking from the Covid-19 pandemic were apparent in the second-quarter financial results the big retail and cobranded card issuer Synchrony Financial reported Tuesday, results which include a 19% year-over-year drop in purchase volume. Stamford, Conn.-based Synchrony posted purchase volume of $31.2 billion versus $38.3 billion in …

Read More »Starbucks Expands Reward-Eligible Payment Methods and other Digital Transactions News briefs from 7/21/20

Coffee king Starbucks Corp. announced new options beginning this fall for earning loyalty points, or stars, in the Starbucks Rewards program without paying with a registered Starbucks physical card or card loaded into the Starbucks mobile app. The options to be available at company-owned stores in the United States and Canada will …

Read More »Its PayPal Deal Having Expired, eBay Acts on Its Global Ambitions for Managed Payments

Free of the restraints of a legal agreement with PayPal Holdings Inc., eBay Inc. said early Monday it will now start on a global expansion of its 2-year-old managed-payments program. The program has already delivered $4.7 billion in total payment volume in the United States and Germany, the company said, …

Read More »The Card Networks and Open Banking; Crypto Platform Joins Mastercard Network and other Digital Transactions News briefs from 7/20/20

Cryptocurrency platform Wirex has become the first such entity to obtain a principal membership in the Mastercard network. The move comes as Mastercard Inc. announced an expansion of its cryptocurrency program, which aims to make it easier for crypto card companies to market their products. Wirex also announced recently it has hired long-time …

Read More »COMMENTARY: How Their Open-Banking Buys Could Propel Mastercard And Visa

The global retail-payment networks Mastercard and Visa are on a tear, acquiring and investing in adjacent payment-opportunity space in networks that can leverage and reinforce their existing franchises. Their traditional payment schemes are dominant worldwide and near indestructible. While for the foreseeable future they could grow on autopilot, to their …

Read More »