Payments-technology provider Stax announced it has acquired payments-gateway provider BlockChyp. Terms were not announced. Payments provider TrustCommerce said its Cloud Payments platform has been certified by all major U.S. processors, including Fiserv, Chase, Elavon, Global Payments/TSYS, and Worldpay. The temporary-staffing platform Indeed Flex is working with payment provider Branch to launch a service called Same Day …

Read More »Wero Ramps Up As a European Account-to-Account Payments Provider And Heads to the Point of Sale

European banks are beginning to roll out a new digital wallet called wero that initially provides account-to-account payments and is expected to be expanded to retail payments as well. If so, wero could prove to be a competitive threat to Visa Inc. and Mastercard Inc., which dominate European payments, raising …

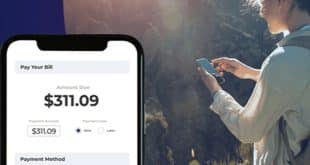

Read More »Paymentus Brings Digital Billing and Payments to Altera Digital Health

Paymentus Holdings Inc., a provider of cloud-based bill-payment technology, has reached an agreement with health-care information-technology provider Altera Digital Health Inc. to include its electronic bill- presentment and payments platform in Altera’s suite of healthcare IT solutions. The deal is expected to streamline the billing and payment processes for health-care providers …

Read More »Strava Teams With Cash App and other Digital Transactions News briefs from 9/27/24

Strava, an online community for athletes, said it is working with Block Inc.’s Cash App unit to launch this year’s HBCU Homecoming Tour, which features running events at U.S. universities. The Consumer Financial Protection Bureau is reportedly seeking comment on Apple Inc.’s practices with respect to contactless payments as the regulator works on …

Read More »Profit-Challenged Lightspeed Acknowledges It’s Exploring ‘A Range of Strategic Alternatives’

Point-of-sale and payments-platform provider Lightspeed Commerce Inc. said Thursday it is exploring “strategic alternatives” in the wake of reports the company might put itself up for sale. “While it is the long-standing policy of Lightspeed not to comment on market rumors, the company notes the recent media reports concerning a …

Read More »Nuvei’s New Services and other Digital Transactions News briefs from 9/25/24

Payments processor Nuvei Corp. launched a number of new services, including decoupled pay-ins and payouts, and split payments. Embedded-finance fintech Sunbit announced an integration with payments-technology platform Stripe. The move will bring Sunbit’s services to a wider array of in-person service businesses, the company says. Business-automation provider BlueBean Technologies Inc. said it has completed an integration …

Read More »AppBrilliance Teams With Wallet Factory to Bring Real Time Payments to Digital Wallets

AppBrilliance Inc., a provider of real-time payments, has partnered with digital-wallet solutions provider Wallet Factory to enable real-time payments on Wallet Factory’s platform. Wallet Factory will use AppBrilliance’s Money API to enable payments on closed-loop digital wallets via The Clearing House’s RTP and the Federal Reserve’s FedNow networks. AppBrilliance launched …

Read More »Mothership Opts for UnionPay and other Digital Transactions News briefs from 9/24/24

Logistics provider Mothership Technologies Inc. announced it has adopted UnionPay as a payment option to ease international transactions. First Pacific Bank will adopt FedNow real-time payments through a connection to software provider Finastra’s Payments to Go platform. Relay Payments said it is extending its trucking and logistics payments network to Love’s Travel Stops. The …

Read More »Payments Rank High on Community Banks’ To-Do Lists

Against a backdrop of continuing industry consolidation, community banks see digital payments as a key competitive weapon, according to newly released survey data from Bank of New York Mellon Corp. “Nearly 30% of those polled indicated that launching new technology services focused on efficiency and security, such as instant payments, …

Read More »Bluefin And Moneris Move to Enhance Point-to-Point Encryption for Merchants

Bluefin Payment Systems LLC expects its deal with processor Moneris Solutions Corp. will significantly streamline Canadian merchants’ payment card security through what the parties say is an enhanced point-to-point encryption solution. Under the terms of the deal, announced last week, Moneris will include point-to-point encryption (P2PE) capabilities in Bluefin’s PCI …

Read More »