Arguments over whether the U.S District Court for the Northern District of Illinois should grant a preliminary injunction to block the scheduled implementation of the Illinois Interchange Fee Prohibition Act were heard yesterday in Chicago. While the judge did not issue a ruling, she did question both plaintiffs and defendants …

Read More »Visa Finishes Strong, Even With the DoJ Taking It to Court

Despite the dark cloud the U.S. Department of Justice’s recent lawsuit over Visa Inc.’s debit business has cast over the network, Visa finished its fiscal year 2024 on a strong note. Among the highlights during Visa’s earnings call late Tuesday were growth in credentials, tokens, and merchant locations, along with …

Read More »Shift4 Puts Its Weight Behind Cryptocurrency as a Payment Option

Shift4 Payments Inc. early Monday gave cryptocurrency a big shot in the arm as a payment option with the announcement it will support digital currencies across its merchant network. Shift4 will support coins including Bitcoin, Ethereum, and Solana SOL, as well as US Dollar Coin and other major stablecoins, …

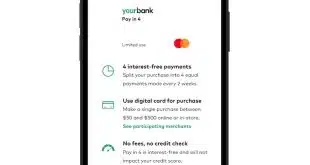

Read More »Mastercard Goes Networkwide With Its Installments Program

Mastercard Inc. announced early Friday it is expanding its Installments payments program to all eligible digital points of sale within its network in the United States. The expansion will enable merchants, financial service providers, payment processors, and digital-wallet providers to present installment offers to consumers through any eligible credit card …

Read More »How the CFPB’s Data Privacy Rule for Open Banking Could Impact Merchants’ Swipe Fees

While the Consumer Financial Protection Bureau is being sued over its data-privacy rule, merchants remain optimistic the regulation will help them reduce the impact of swipe fees by making account-to-account payments widely available at the point of sale. The key is open banking, which paves the way to developing payment …

Read More »Banks Take Aim at the CFPB’s Data Privacy Rule for Open Banking

No sooner had the Consumer Financial Protection Bureau released its personal financial data rights rule Tuesday than the rule was legally challenged by the banking industry. The lawsuit, filed late Tuesday by the Bank Policy Institute and the Kentucky Bankers Association, alleges the CFPB has overstepped its bounds by issuing …

Read More »The CFPB Releases Its Data Privacy Rule for Open Banking

The Consumer Financial Protection Bureau has finalized its personal financial data-rights rule aimed at governing the sharing of consumer data through open banking. The new rule, released early Tuesday, will require financial institutions, credit card issuers, and other financial providers to share data at a consumer’s direction with companies offering …

Read More »Thunes And Nium Extend Swift Capability to Enable Cross Border Real-Time Payments

Real-time payments network Thunes Ltd. announced early Monday its connection to Swift, the Brussels-based international financial-messaging network, will enable financial institutions to support the sending and receiving of money to and from more than 3 million mobile wallets globally. Using Thunes’s Direct Global Network, which covers 130 countries and 80 …

Read More »Better Armed Cyberthieves Means Fewer Breaches, More Effective Attacks

Despite the number of data breaches during the third-quarter of 2024 declining 8% from the previous quarter, criminals are better armed than ever for carrying out these nefarious attacks, according to the Identity Theft Resource Center. One factor making it easier for criminals to initiate a data breach is the emergence …

Read More »Zelle Posts Strong 2024 First Half Growth

Zelle, the peer-to-peer payment network operated by Early Warning Services LLC, announced early Thursday that consumers and small businesses sent $481 billion dollars over the network during the first half of 2024, a 28% increase from the same period a year ago. Zelle users sent $1.8 million per minute, $110 million …

Read More »