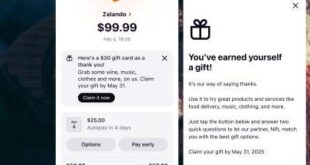

Buy now, pay later specialist Klarna AB is working with gift card platform Nift to boost customer engagement while retailer Dick’s Sporting Goods says it will renew its buy now, pay later deal with Affirm Inc. In the partnership announced Thursday with Nift, Klarna will be able to create gift …

Read More »Eye on Point of Sale: PAR Engagement Debuts; Global’s Genius for Retail Released

Competition at the point of sale is just as tough behind the counter as in front. Two payments companies separately are launching new products they hope will give them an edge. PAR Technology Corp. released PAR Engagement, a portfolio of products meant to help enterprise restaurants win over more customers, …

Read More »Cross River Bank Adds Request for Payment on RTP

Plaid Inc., the open-banking technology provider, will be the first Cross River Bank client to enable a much-desired request-for-payment function for real-time payments, Cross River announced Monday. As part of The Clearing House Payments Co. LLC’s RTP network, request for payment allows businesses to send a secure request for payment, …

Read More »PayPal Credit Users To Get a Card for In-Store Use

Consumers with PayPal Credit accounts soon will be eligible for a new Mastercard Inc. branded card to use in store with their accounts. Announced Tuesday, the new card taps consumer credit lines in their PayPal Credit accounts, which are issued by Synchrony Financial. PayPal Credit accounts have been most associated …

Read More »Mastercard’s Small Business Navigator Aims to Level up Small Businesses

Filled with ideas and enthusiasm, U.S. small businesses have the drive to grow their businesses, but a low availability of tools and resources may hamper some of that ambition. Mastercard Inc. says its new Small Business Navigator can help with that. The program offers education, insights, protection, and planning tools, …

Read More »Expect More AI in Fraud Prevention Measures, a Survey Finds

As the nascent artificial-intelligence field develops, financial institutions are readying to adopt AI in their fraud-prevention measures just as criminals are devising AI-enabled ways to make their schemes more harmful. Evidence of this is that 43% of financial institutions surveyed for the DataVisor “2025 Fraud and AML Executive Report” will …

Read More »Eye on Fraud Prevention: TIS’s Fraud Prevention Boost; Chargeflow and Seon’s Integration

The more than 7,000 U.S. travel agencies have another tool to help prevent fraud with a new service from Travel Industry Solutions. Meanwhile, chargeback-automation platform Chargeflow and Seon, a fraud-prevention and compliance provider, have integrated Chargeflow’s technology into the Seon platform. Altamonte Springs, Fla.-based TIS says its tool is the …

Read More »Visa’s Payments Forum Notes a Digital ID Expansion

Visa Inc. is heralding a number of advances in payments technologies, among them the growth of digital-identity services related to payments, continued contactless-payments penetration, and progress with its Flex Credential. Visa said its efforts to create secure digital-identity technology, aimed at making the checkout more secure, is advancing. Central to …

Read More »Eye on Point of Sale: Lightspeed Marks $1 Billion in Revenue; Manhattan Associates Secures a Shopify Presence

In a first, point-of-sale system and e-commerce platform Lightspeed Commerce Inc. exceeded $1 billion in yearly revenue, posting $1.1 billion for its fiscal year ended March 31. That’s up 21% from $909 million the previous year. It wasn’t enough, however, to offset financial performance, resulting in a loss for the …

Read More »Eye on BNPL: Pay-Over-Time Besting Credit Cards for Some; Afterpay Lines up More Merchants

The predictability of buy now, pay later loans and the interest-free nature of many of them is appealing to merchants, as many consumers—86%—believe the economy is uncertain, finds a new report from Affirm Inc. Commissioned by installment-payment provider Affirm, the survey, conducted by Talker Research in March of 2,000 U.S. …

Read More »