Square announced early Tuesday its first integration in the United Kingdom of Clearpay, a buy now, pay later service known as Afterpay outside the U.K. and Europe. Square, the point-of-sale payments unit of San Francisco-based Block Inc., said the latest move is also its first major integration of BNPL in the U.K. following Block’s $29-billion acquisition of Australia-based Afterpay earlier this year.

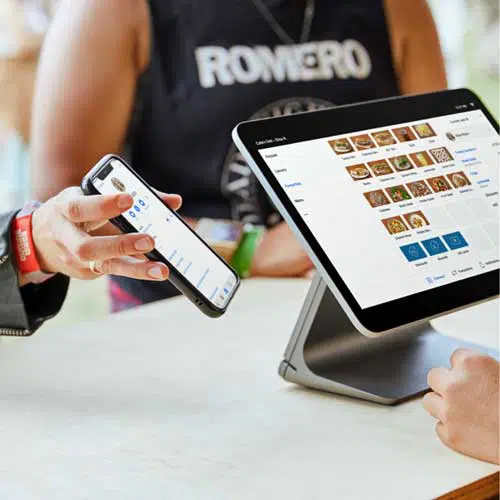

Square said the new U.K. service will be available simultaneously on “all platforms,” including in-store and online. It is also open for integration by independent Square developers. The news follows similar integrations of BNPL in Square technology in the United States and Australia.

Square’s move follows a continuing wave of popularity for the installment-payment service, which has enjoyed a fast-rising uptake in the United States and internationally since the onset of the Covid pandemic. The latest Square integration will automate a process by which customers in the U.K. can elect to pay for purchases in four installments at no interest across a six-week span. Merchants are reimbursed immediately following the sale.

The platforms covered by the new integration include Square Point of Sale, Square Appointments, Square for Retail, and Square for Restaurants. For e-commerce, Clearpay will become available in Square Online, the company’s checkout technology, Square said. “The integration across platforms furthers our goal to give sellers of all sizes omnichannel tools that help them to grow by meeting consumer shopping habits,” said Alyssa Henry, head of Square, in a statement.

Square reported that BNPL in the U.K. commanded 13 billion pounds ($15.4 billion) in spending last year, making it the country’s fastest-growing online payment method. By 2025, that volume will double to account for 12.1% of all U.K. e-commerce spending, according to the company.

Square clearly hopes to see results in its U.K. market that will mirror what it has experienced in the U.S. and Australia. It reported that in these two markets the average transaction size with Afterpay is three times greater than without. Sales are higher in the U.S., with, for example, men’s and women’s clothing stores reporting 17% higher sales with BNPL, Square said.

In the U.S. market, separate research from credit-reporting agency TransUnion Tuesday indicates 37% of U.S, shoppers have already used, or plan to use, a BNPL option for back-to-school purchases. The research indicated shoppers may be finding BNPL options to be especially useful in the face of higher inflation.