The financial crisis of 2007-09 forced many banks to retreat from small-business lending, leaving a gap that digital-payments companies have rushed to fill. The latest move in this direction came Thursday, when PayPal Holdings Inc. said it has a deal to buy Swift Financial Corp., a Wilmington, Del.-based lender founded …

August, 2017

-

10 August

Cyberattacks Doubled in Just Two Years, Authentication Provider Says

ThreatMetrix Inc., a provider of digital-identity and authentication services, reports that its network detected and stopped 144 million cyberattacks in the second quarter, a 100% increase from 2015’s second quarter. ThreatMetrix says its Digital Identity Network from April through June also stopped 300 million bot attacks in which hackers take …

-

10 August

ISO To Resell CardFlight Card Reader and other Digital Transactions News briefs

Mobile point-of-sale services provider CardFlight Inc. announced that payments provider Central Payment will offer CardFlight’s SwipeSimple mPOS reader to merchants. Fidelity National Information Services Inc. (FIS) said home-improvement retailer Lowe’s will use FIS’s BizNOW prepaid service—labeled as Lowe’s PreLoad—to enable contractors to automate their purchasing activities, eliminating the need for their employees to …

-

9 August

Vantiv To Take Worldpay’s Name In a Merger That Will Create a Global Acquiring Powerhouse

After two delays, processor Vantiv Inc. and London-based merchant acquirer Worldpay Group plc finally announced a formal deal Wednesday that has Vantiv acquiring Worldpay in a deal that creates a global processing powerhouse. The cash and stock deal values Worldpay at $12 billion, a 34% premium to Worldpay’s six-month volume-weighted …

-

9 August

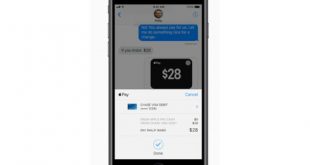

Green Dot Provides Some Details About its Role in the Upcoming Apple P2P Service

Prepaid specialist Green Dot Corp. released more details about its role in Apple Inc.’s upcoming person-to-person service in its Messages app. Apple announced the new feature in June and is expected to make it available this fall with an update to its iOS software for iPhone and iPads. Pasadena, Calif.-based …

-

9 August

Less Cash Use Triggers ATM Contract Re-Bid and other Digital Transactions News briefs

Declining use of cash at Atlanta’s Hartsfield-Jackson International Airport has prompted the Atlanta City Council to re-bid a contract for banking services at the world’s busiest airport after only one bank, SunTrust, responded to the original proposal, the Atlanta Journal-Constitution reported. The incumbent, Wells Fargo, claims ATM revenues have declined and that its …

-

8 August

After CardFree’s Suit Against LevelUp, the Mobile Specialists Trade Salvos in Court Filings

Litigation between CardFree Inc. and Scvngr Inc., better known as LevelUp, has taken a nasty turn in recent weeks, with LevelUp accusing CardFree of high-pressure tactics outside the courtroom and CardFree charging LevelUp with more instances of fraudulent access to its mobile order-ahead-and-pay system. In its June 21 answer to …

-

8 August

With High and Low Spots, Open-Loop Prepaid Loads To Top $353.6 Billion by 2020: Report

Overall, the forecast is strong for open-loop prepaid cards—loads are expected to reach $353.6 billion by 2020—but not every segment will partake in the growth. That’s the assessment in a new report from Mercator Advisory Group Inc. Open-loop cards, which can be used at most merchants and carry a major …

-

8 August

Wells Fargo Merchant Services Sued and other Digital Transactions News briefs

Worldpay has asked for second extension, this time to Aug. 11 after a first one to Aug. 8, of a British regulatory deadline as Worldpay and Vantiv Inc. executives put the finishing touches on Vantiv’s proposed $9.9 billion buyout offer for the London-based merchant acquirer. Reuters reported that the companies expect to announce a final …

-

7 August

Transactions Bloom on First Data’s Clover Devices, but Merchant-Acquiring Ventures Lag

First Data Corp. executives Monday highlighted rapid growth in the processor’s Clover Network line of tablet-based point-of-sale devices, and also said attrition has come down significantly among small merchants. Not so hot are First Data’s joint merchant-acquiring ventures with big banks, but the company insists their revenue softness is only …