In a move that could weave cryptocurrency more deeply into the fabric of the U.S. payments industry, Circle Internet Group Inc. announced late Monday it has applied to the Office of the Comptroller of the Currency to form a national trust bank. The application, which seeks to establish what Circle …

Read More »As Colleges Pay Athletes, PayPal Looks to a Big Role in the Big 10 and Big 12

PayPal Holdings Inc. will process payments from universities to student athletes under multi-year deals the payments company announced early Thursday. PayPal’s agreements with the Big 10 and Big 12 college conferences follows a court ruling June 6 that permits colleges and universities to include student athletes in a revenue share. …

Read More »Fiserv Will Work With Circle to Develop Stablecoin Products

Fiserv Inc. and Circle Internet Group Inc. early Monday announced they will collaborate to build products based on stablecoins for banks and merchants in Fiserv’s client base. The announcement came at the same time Fiserv said it plans to launch its own stablecoin, FIUSD, by year’s end. Simultaneously, Fiserv said …

Read More »As More Countries Adopt Stablecoin Laws, Usage Is Likely to Spread

With rules governing stablecoins under development in the U.S. Congress, there are now at least 14 countries and regions worldwide that have established or are considering regulations for the digital currency. The need for regulations in jurisdictions around the globe comes as stablecoins grow in awareness and usage and pose …

Read More »The Future of Stablecoins Hangs on Action From Congress

With action Tuesday by the U.S. Senate to pass the GENIUS Act, the move to establish rules that would govern the burgeoning stablecoin industry now transits to the U.S. House of Representatives, where lawmakers have developed their own set of rules, the STABLE Act. Meanwhile, stablecoin-market participants are looking to the …

Read More »Stablecoins Get a Boost As Walmart And Amazon Look to Adopt Them

Stablecoins are starting to move beyond niche status. Both Walmart Inc. and Amazon.com Inc. are investigating whether to issue the digital currency in the U.S. market, The Wall Street Journal reported early Friday. Details are sketchy. Neither megamerchant responded to queries about the matter from Digital Transactions News. It also …

Read More »Circle Allies With Matera to Push Stablecoins Into Routine Usage

Circle Internet Group Inc. is working with Matera Inc., a developer of banking technology, in a move aimed at speeding adoption of stablecoins by individuals and companies, the two firms announced early Wednesday. In the collaboration, Matera will integrate its Digital Twin real-time ledger with Circle’s platform to support routine …

Read More »‘Buy Now, Pay Never’ Debuts for Crypto, While Circle Soars on Wall Street

As cryptocurrency such as stablecoins inch toward mainstream acceptance, some platforms are starting to adapt slogans borrowed from the established world of payments. In the latest example, a new San Francisco-based company called NeverPay announced early Friday a program called Buy Now, Pay Never, which it says will let users …

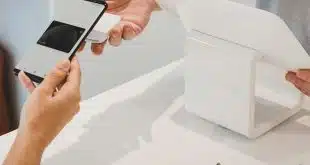

Read More »How Tap-to-Pay Has Evolved—And What Comes Next

Ever since the card industry launched technology that lets merchants process transactions through an off-the-shelf mobile device, companies have worked to refine the idea further. Now, consumers can look forward to making remote purchases with a tap on their phone’s screen when they see something they want, according to payments …

Read More »How a Canny Bank Is Making Its Mark In Cannabis Payments

Cannabis remains a federally illegal drug in the United States, but various states have acted over the past decade to legalize it and sales continue to grow fast enough that the market remains potentially lucrative for processors and banks. An example of how a major financial institution has entered this …

Read More »