Stripe Inc. early Monday launched a series of enhancements aimed at improving checkouts for merchants. The new features—which include one-click checkouts and a no-code A/B testing tool for businesses to evaluate how different payment methods perform—rely on pre-built user interfaces. This should allow merchants to quickly deploy the new features, as they wouldn’t have to develop the programming code themselves, Stripe says.

A so-called Payment Element within Stripe’s enhanced-checkout suite of apps uses algorithms trained on billions of data points to present consumers with what it determines to be the most relevant payment methods from more than 40 options. For example, the Payment Element could suggest to French consumers shopping in Japan that might pay with Cartes Bancaires, while suggesting local payment options to Japanese consumers.

Stripe now offers merchants access to more than 100 payment methods, including RevolutPay, Mobile Pay—a mobile-payment app popular in Denmark and Finland—bank transfers in the United States, and Swish, a payment app that enables consumers to send money to businesses or friends using their mobile phone.

Another enhancement is the addition of an A/B testing tool aimed at allowing businesses to identify the best-performing payment methods in their checkout and make data-driven improvements. Using the tool, Thinkific, a software platform that enables entrepreneurs to create, market, sell, and deliver their own online courses, found that offering buy now, pay later increased average order value by 36%, according to Stripe.

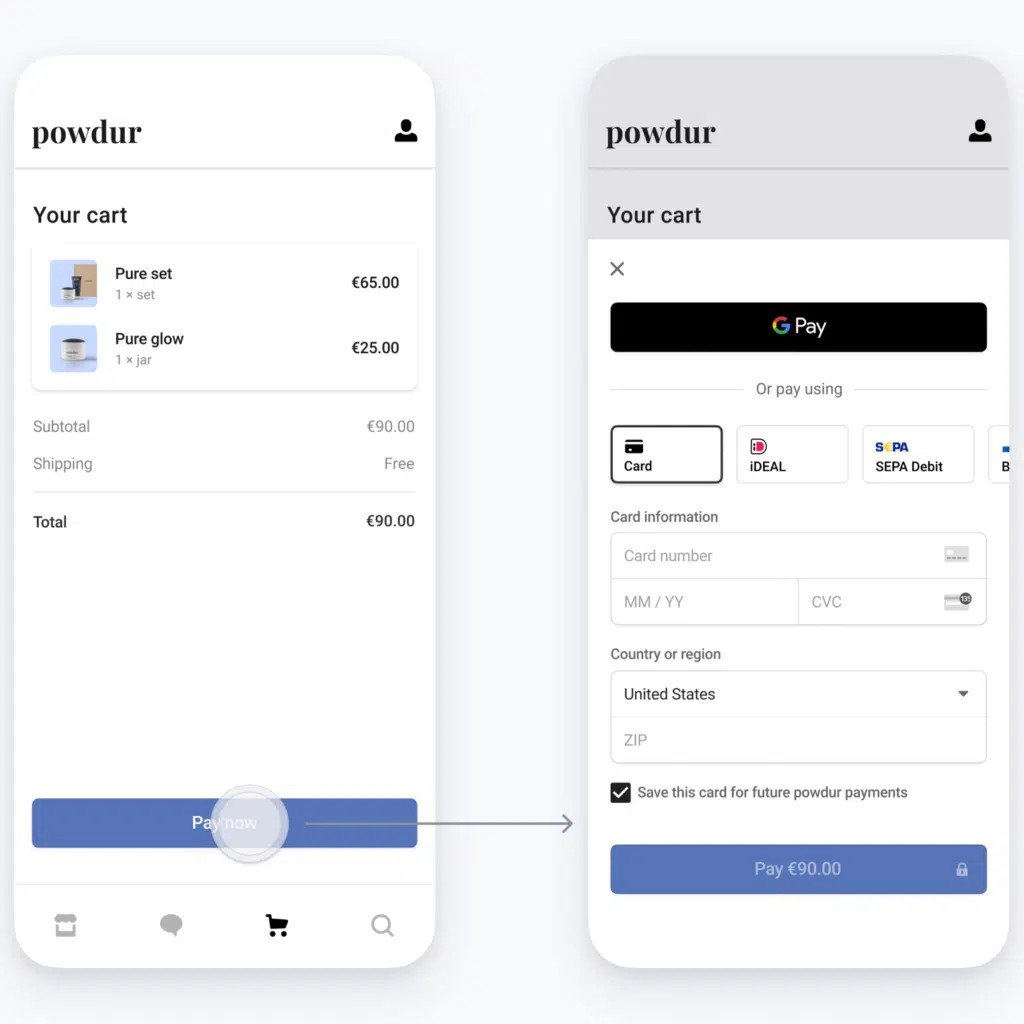

Stripe’s Express Checkout Element enables users to display multiple one-click payment buttons, such as Apple Pay, Google Pay, or Link. Only payment options that are supported by the device or the browser a customer is using are shown. The options are said to be ordered in terms of relevance to the consumer.

After adopting Stripe’s enhanced-checkout suite of apps, River Island, a multichannel fashion retailer, saw a 4% improvement in its credit card authorization rates and anticipates significant revenue gains in the coming year, Stripe reports.