Consumer electronics giant Samsung Electronics is looking to expand to 13 new markets for its Samsung Wallet service.

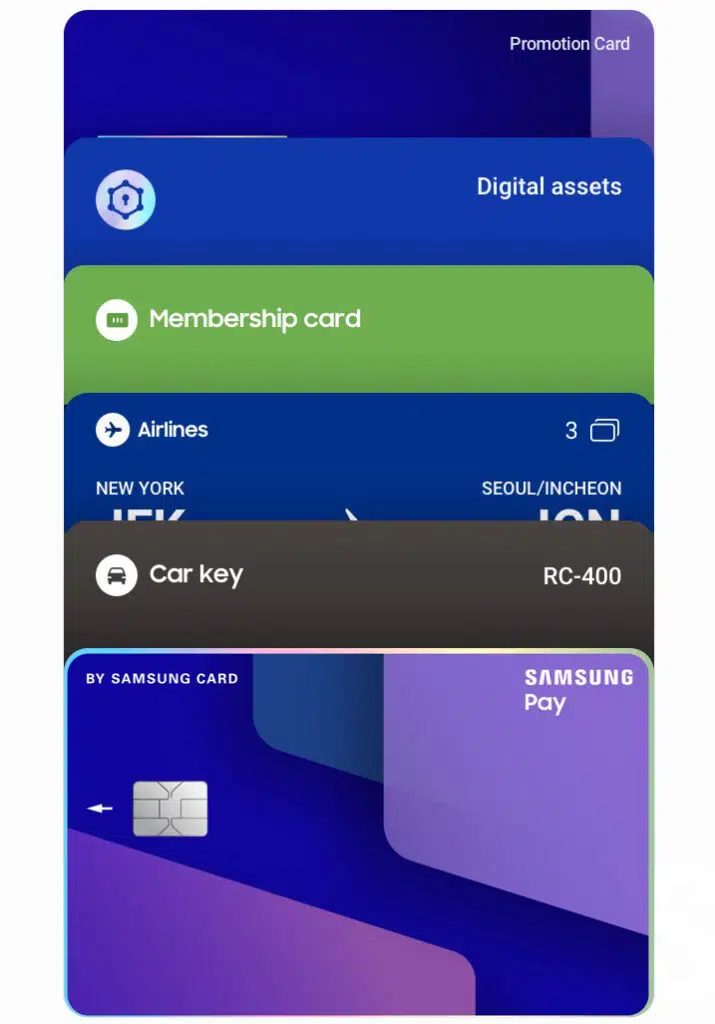

Announced Friday, the expansion of the digital-wallet platform will more than double its presence from the eight nations where it is already available. Samsung Wallet is the new brand for the combined Samsung Pay and Samsung Pass service. Users not only can store payment cards in the wallet, but digital keys, boarding passes, and electronic identification documents. Its competitors, Google Wallet and Apple Wallet, offer similar capabilities. All three mobile apps were launched at roughly the same time in 2015.

Samsung says the expansion, which includes markets such as Denmark, Kuwait, South Africa, and Vietnam, will begin this year. “We are focused on bringing the platform to as many markets as possible, as soon as possible, so more Samsung Galaxy users have the opportunity to reap the benefits of the digital wallet,” Jeanie Han, Samsung executive vice president and head of its Digital Life Team at Mobile eXperience Business, says in a statement.

In the mobile wallet arena, scale is the game. That leads operators to conclude that the more services that can be added and the more places the wallet can be used, the better.

“As is often the case in payments, scale is the name of the game when it comes to mobile wallets. Adding support for more countries should help Samsung Wallet increase its user base, thus deepening its value proposition for partners,” Jordan McKee, director of fintech research and advisory practice at 451 Research/S&P Global Market Intelligence, says in an email to Digital Transactions News.

There may still be room for more U.S. mobile-wallet growth, too. “In Q3, 44% of U.S. consumers used mobile wallets to make purchases in-store, according to 451 Research’s Disruptive Technologies Consumer Survey,” McKee says. “While these usage rates are promising, they also indicate there is still much more room for growth in the U.S. market. Adoption of Samsung Pay in the U.S. is still limited, with just 6% of consumers having used it in Q3.”