American Express Co. early Friday indicated growth rates for total network volumes, while still negative, have rebounded to first-quarter 2020 levels as economies re-open, anti-Covid vaccinations progress in major markets, and consumer travel recovers. “Our overall core business performance was slightly better than our expectations,” said AmEx chief executive Stephen …

April, 2021

-

23 April

Southwest Offers Uplift BNPL Option and other Digital Transactions News briefs from 4/23/21

Uplift Inc., a buy now, pay later provider specializing in travel, said consumers can now buy tickets on Southwest Airlines Co. flights and pay in installments.Some 79% of gift card buyers expect to increase spending on gifts when pandemic restrictions are relaxed or lifted, according to a survey of 1,056 …

-

22 April

COMMENTARY: Why Cryptocurrency at the Point of Sale Is the Next Contactless Step for Merchants

How people purchased goods and services online, at the in-store point of sale (POS), or on mobile devices changed significantly during the pandemic. Whether or not businesses closed their brick-and-mortar storefronts, they experienced a shift to contactless and online channels as a safer way to transact for businesses and consumers. …

-

22 April

Square Bolsters Its Retail Management App With New Inventory Management Tools

Square Inc. announced Thursday the addition of three inventory-management features to its cloud-based retail-management app, Square for Retail. Merchants can use the new features to build an inventory library, track inventory by warehouse or store, transfer stock as needed, and reorder inventory with one click. The new features arrive as …

-

22 April

With Its $960 Million Deal for First American, Deluxe Catapults Itself Into Merchant Acquiring

Deluxe Corp. is best known as the largest supplier of checks in the United States, but early Thursday it showed how serious it is about staking a major claim in digital payments. The Shoreview, Minn.-based company announced it has agreed to pay $960 million in cash for First American Payment …

-

22 April

Pulse Volume up 23% and other Digital Transactions News briefs from 4/22/21

Discover Financial Services reported $1.6 billion in net income in the 2021 first quarter, a reversal of a $61 million loss in the same quarter in 2020. Discover said its payment services volume was $75.9 billion, a 19% increase year-over-year. Dollar volume on its Pulse debit network increased 23% year-over-year, driven …

-

21 April

Amazon Expands its Amazon One Pay by Palm Technology to Whole Foods Stores

Amazon.com Inc. is expanding its Amazon One biometric payment technology to Whole Foods stores in Seattle. Amazon, which launched Amazon One in its two Seattle Amazon Go stores last September, will initially roll the technology out to a Whole Foods store near its headquarters and eventually to seven more stores …

-

21 April

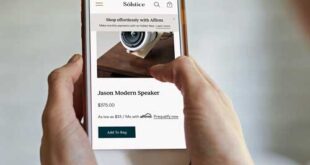

Online Returns Come to BNPL As Affirm Makes a $300 Million Bid for Specialist Returnly

The buy now, pay later trend has eased online purchases for consumers over the past year, but at the other end of those transactions is the flow of returns after buyers get their merchandise. Now Affirm Holdings Inc., a leading player in the fast-growing BNPL arena has attacked the issue with …

-

21 April

Worldline Revenue Drops and other Digital Transactions News briefs from 4/21/21

French processor Worldline S.A. reported its first-quarter merchant-services revenue dropped 8.7% year-over-year to 517 million euros ($621 million), while its terminals and software unit saw a 16.5% decline to 266 million euros ($320 million). Worldline acquired terminal maker Ingenico Group S.A. in October.FIS Inc. said it has won a domestic acquiring license for its Worldpay …

-

20 April

North America Becomes Afterpay’s Largest Market for its Buy Now, Pay Later Services

North America has emerged as the largest sales-generating region for buy now, pay later provider Afterpay Ltd. In the Australia-based company’s latest financial results, North America sales accounted for A$2.6 billion (US$2 billion) in the third quarter ended March 30. Only Australia and New Zealand approach that volume. Overall, Afterpay said …