Flexa Network Inc., a payments provider based on digital currencies, has agreed to support in-store cryptocurrency acceptance at Bealls Inc., operator of more than 660 stores in 22 states under Bealls and other brand names. The move, announced Monday afternoon, represents one of the largest planned deployments of in-store crypto acceptance so far, and one of the first involving a major department-store brand.

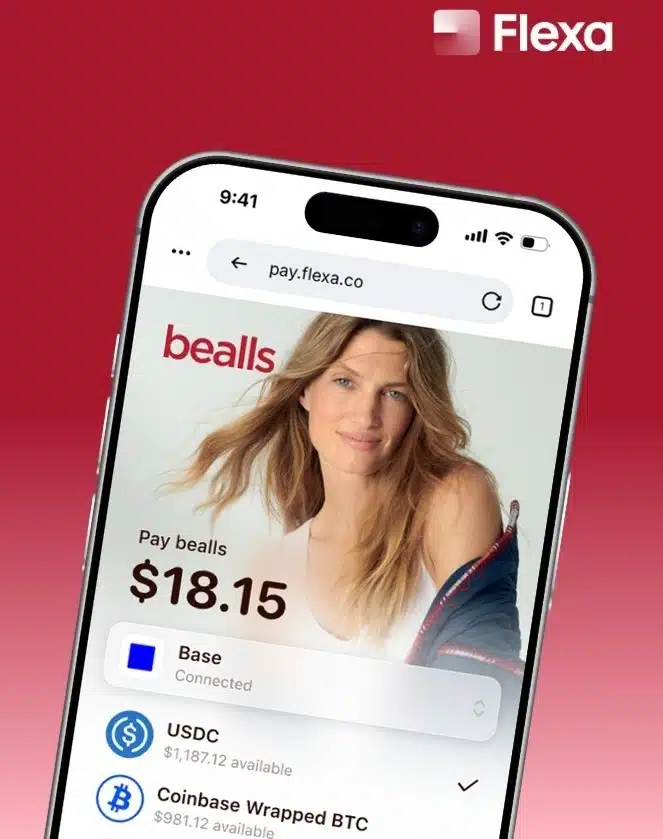

The point-of-sale integration with Bealls will leverage Flexa Payments, a service that supports Bitcoin, the most well-known digital currency, but also other blockchain products including ether and stablecoins. All told, the system will enable acceptance of at least 99 cryptocurrencies, according to Flexa’s news release. The company did not immediately respond to queries from Digital Transactions News.

Bealls’s top management sees the move as a way to prepare for what could become more widely used payment options in the near term. “Digital currency will reshape how the world transacts,” said Matt Beall, chairman chief executive at Bradenton, Fla.-based Bealls, in a statement. “And Bealls is proud to be at the forefront of that transformation. Our partnership with Flexa is about more than payments. It’s about preparing for the future of commerce and continuing to innovate for the next 110 years.” Privately held Bealls was founded in 1915.

Observers see the news as a sign of increasing confidence among merchants and payments companies that crypto payments can work for larger commerce environments. Point-of-sale companies like Shift4 Payments and Block Inc.’s Square operation have looked to expand merchant acceptance of crypto for years.

But the number of stores involved distinguishes the Bealls venture with Flexa, observers say. “Apart from gateways [and] processors that have recently announced crypto capabilities, this is certainly the largest merchant I’m aware of implementing a crypto-capable solution,” says Cliff Gray, proprietor of Gray Consulting, in an email message. “It strikes me as a fairly low-friction solution, accepting multiple cryptocurrencies and wallets and other features.”

The planned Bealls deployment impresses Gray, who calls it “quite a sample size.” Wide-scale adoption by shoppers, he adds, “will prove potent for Bealls through cost and risk reduction, much less validate the strategy for other players. I am most curious to see how this plays out.” Acceptance costs for cryptocurrencies can vary by provider, merchant, volume, and other factors, but digital currency is generally seen as less expensive for merchants at a time when sellers have grown weary of acceptance costs for cards.

Merchant and consumer interest in cryptocurrency, particularly stablecoins, has grown since the GENIUS Act took effect in July. The legislation sets out rules that observers say can lead to wider deployment and acceptance as players like 7-year-old Flexa and merchants like Bealls grow more confident in the technology’s appeal. Blockchain-generated currency also benefits from its transaction speed, fast authorizations, and resistance to fraud, observers say.

But crypto isn’t credit or debit cards, transaction methods consumers are accustomed to and whose rules reassure users regarding such matters as fraud and disputes. In this way, the chainwide Bealls venture will be telling, experts say. “Now that all the rails are in place, I’ll be watching for two results,” Gray says. “Will consumers actually use crypto, and will consumers be dissuaded by losing dispute rights.”