When it comes to online checkout, consumers like using digital wallets. Seventy-two percent of them value digital-payment tools like digital wallets to make the online checkout easier, says Paze in its inaugural Paze Pulse report.

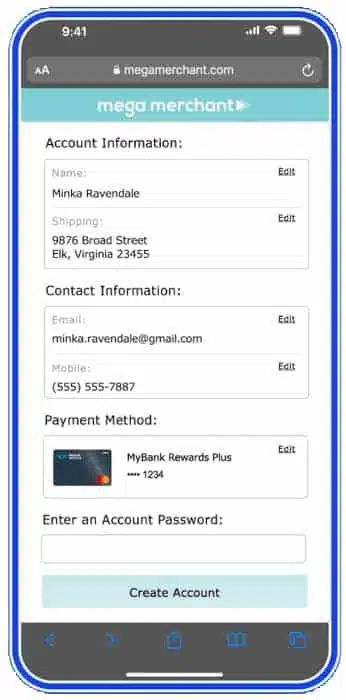

Paze is an upcoming digital wallet from Early Warning Services LLC. Backed by seven large U.S. banks, the wallet could come preloaded with up to 150 million credit cards and billing addresses, eliminating some of the tedium consumers experience when having to type that information in.

Consumers will be able to add different shipping addresses and store them in Paze, too. The wallet also features a card-updater capability. In addition, the issuer can send a notice in the Paze wallet asking the consumer to update the expired card, after verification with a one-time password and supplying a card-security code.

Friction at checkout is a problem for all e-commerce merchants. The report found that 71% of online shoppers have abandoned their shopping carts, mostly because of a complicated checkout process and security concerns.

The report also found that 44% of the 1,000 consumers surveyed would use a digital wallet provided by their bank over the guest checkout option. One factor for that preference may be a sense of security. Eighty-two percent say they trust their bank’s safety and security more than third-party payment options.

Safety and security of the online checkout is important for consumers Sixty-seven percent list a secure checkout process as one of the top three factors they consider when shopping online. Among those who use a digital wallet, 85% consider them safe, compared with 79% who say so when manually entering payment information in a guest checkout, and 75% who use an app from a retailer or business.

“This research indicates strong consumer interest in using an online checkout solution, offered by banks and credit unions, and validates our direction with Paze as we prepare for its general availability this year,” James Anderson, Paze managing director, says in a statement. Paze is scheduled to have broad availability later this year.

Other data from the report, which was conducted by Murphy Research, found that 41% of consumers would use a digital payment tool if it was already set up, but they revert to guest checkout because it seems easier.

Early Warning also provides Zelle, the bank-backed person-to-person payments service.