Less than a year after going public, Bitcoin ATM network deployer Bitcoin Depot Inc. on Monday said it is eyeing substantial growth in 2024. Meanwhile, blockchain technology provider BTCS Inc. swung to a profit in 2023 after a loss in 2022.

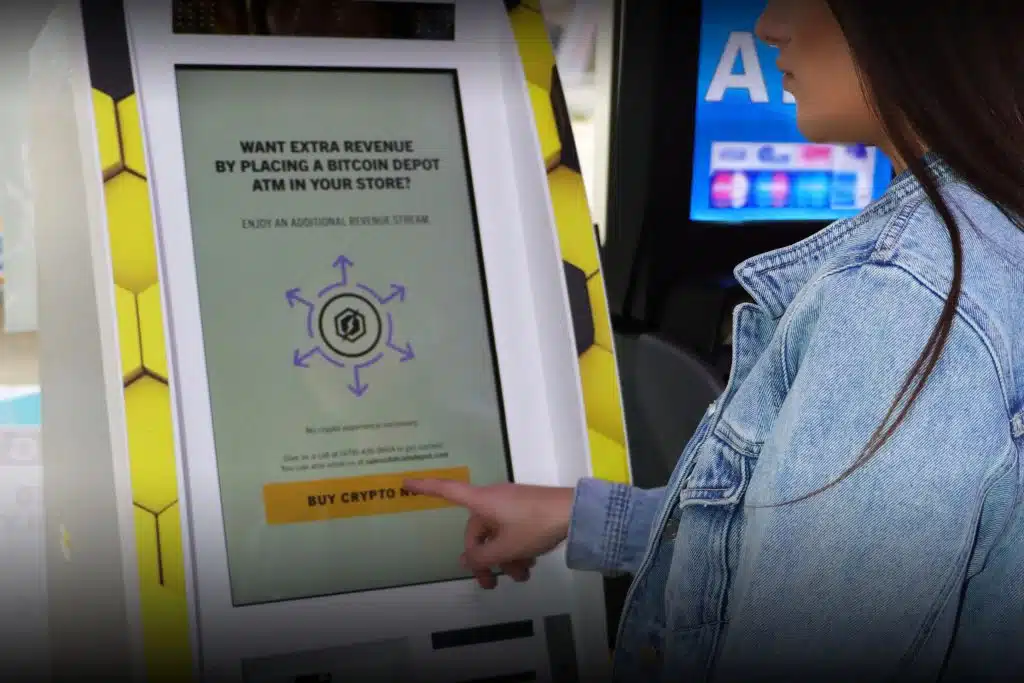

Recent developments from Atlanta-based Bitcoin Depot include the purchase of 900 Bitcoin ATMs as part of its expansion plans for 2024’s first quarter. The company also sold 50 new Bitcoin ATMs to Sopris Capital for its franchise program.

Bitcoin Depot said in its latest earnings report that it had deployed kiosks in 6,339 retail locations throughout North America as of Dec. 31. Recently signed retail partners include FastLane, Gas Express, High’s, Majors Management, Stinker Stores, GetGo Café + Market, and Jacksons Food Store. One recent deal with an unidentified convenience-store chain will put Bitcoin Depot kiosks in 63 more stores.

And, as of March 2023, the company offered its BDCheckout product at 2,754 retail locations. BDCheckout enables consumers using the Bitcoin Depot app to buy cryptocurrency at partner stores.

Bitcoin Depot, whose shares trade on the Nasdaq Stock Market, went public last June when Lux Vending LLC, which does business as Bitcoin Depot, merged with GSR II Meteora Acquisition Corp., a special-purpose acquisition company.

The expansion plans were unveiled as the company reported financial results for the fourth quarter and 2023. Revenue for the quarter ended Dec. 31 was $148.4 million, down 1% from a year earlier. For the full year, revenue grew 7% to $689 million. The company posted a net loss of $1.5 million in the fourth quarter versus a loss of $500,000 in 2022’s fourth quarter. Bitcoin Depot reported net income of $1.6 million for 2023, down from $3.5 million in 2022.

In related news, Silver Spring, Md.-based BTCS, another publicly traded company in the cryptocurrency industry, on Friday reported revenue of $1.3 million in 2023, down 20% for the year. Net income of $7.8 million, however, represented a turnaround from 2022’s loss of $15.9 million. The company in a statement attributed the improvement to “financial reporting changes resulting from the adoption of new accounting standards.”