One impression of consumers who use buy now, pay later services is that they may not be as financially literate as others. New data from Capterra, a software reviews and selection platform, indicate that picture may not be entirely accurate. In Arlington, Va.-based Capterra’s “2022 Buy Now, Pay Later Survey,” …

December, 2022

-

14 December

Billtrust Goes Private And Other Digital Transactions News briefs from 12/14/22

BTRS Holdings Inc., also known as Billtrust, said it will go private on Dec. 16 through a merger with an affiliate of EQT X Fund. The business-to-business payments provider went public in January 2021 through a merger with South Mountain Merger Corp., a special purpose acquisition corporation, or SPAC. Payments provider ACI Worldwide said it …

-

13 December

Facing Fast Growth, Payment Providers Plan a Hiring Blitz in 2023

At a time when many businesses are struggling to fill job openings, payments provider VizyPay LLC announced on Tuesday it is planning a “hiring blitz” in 2023. In preparation for the influx of new employees, the Waukee, Iowa-based processor named Alex Schaeffer director of learning and development and Marj Chaffin …

-

13 December

The CFPB Proposes to Publish Details on State or Local Enforcement Actions

The Consumer Financial Protection Bureau has become a much more active regulator of payments and other financial industries since the onset of the Biden Administration, and on Monday the agency lent further momentum to that trend. The 11-year-old federal agency is now asking for public comment on a proposal that …

-

13 December

POS Updates Top-of-Mind for Restaurants And Other Digital Transactions News briefs from 12/13/22

Point-of-sale system maker TouchBistro released its 2023 “State of Restaurants” report that found 76% of restaurant operators changed their POS systems in the past year and 66% used a system with an integrated payment processing service. The study, now in its fifth year, was based on research from 600 full service restaurant …

-

12 December

Eye on Cannabis: Merrco Brings BNPL to Cannabis Sellers; Aeropay Partners with HighHello

Toronto-based Merrco Payments Inc., which specializes in cannabis-payments processing, is partnering with buy now, pay later provider Gratify Payments Inc. to enable cannabis merchants in Canada to offer BNPL loans as a payment option. Offering the installment payments is expected to help Canadian cannabis merchants upsell customers on accessories and …

-

12 December

Global Card Networks Are Thriving, Though Domestic Systems Could Pose a Threat

The number of card-accepting merchant locations around the world reached a record high of 88 million in 2021, up 2% over 2020 as measures to fight the pandemic helped stoke consumer usage of payment cards rather than alternatives like cash, according to research released Monday by London-based research firm RBR. …

-

12 December

Shift4 Notes Europe Foray And Other Digital Transactions News briefs from 12/12/22

U.S. payments provider Shift4 Payments Inc. said it has now processed transactions in Europe on its SkyTab point-of-sale platform for restaurants and its VenueNext service for mobile ordering and payment at stadiums and other facilities. The company said it plans to launch the two platforms commercially in Europe next year. Kansas-based processor Euronet Worldwide Inc.’s epay …

-

9 December

TreviPay Looks to Faster And More Flexible Payments With Its Deal to Acquire Apruve

Payments provider TreviPay has reached an agreement to acquire business-to-business payments processor Apruve for an undisclosed sum. TreviPay positions the acquisition as part of its ongoing global expansion plan to make payments faster and more flexible for its clients. It will also enable Overland Park, Kan.-based TreviPay to leverage Apruve’s …

-

9 December

COMMENTARY: How Banks And Credit Unions Can Create a Top of Wallet Experience for Consumers

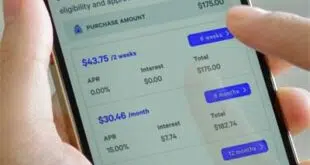

As the holiday season continues and the cost-of-living rises, shoppers are searching for meaningful yet budget-friendly gifts for loved ones. Consumers need financial flexibility to make large purchases without using their entire paycheck to do so. Buy now, pay later solutions continue to rise in popularity as consumers search for …