Cantaloupe Inc. is rolling out Cantaloupe Go, a line of self-service apps and kiosks that rely on artificial intelligence to enable consumers to purchase products in self-service retail locations, such as micro-markets. Cantaloupe Go comprises Cantaloupe’s line of self-checkout kiosks. which vary in cost, features, and payment-acceptance capabilities; Smart Store …

Read More »Merchants’ Cost Burden for Card Acceptance Has Long Been Flat, a Card Industry Group Argues

Merchants’ price for accepting credit cards has remained steady for years, according to data released Monday by the Electronic Payments Coalition, an advocacy group representing the payment card industry. The EPC’s release comes as widespread and longstanding merchant complaints about the cost of card acceptance have sparked efforts by federal …

Read More »Virsympay’s New Gateway And Other Digital Transactions News briefs from 5/8/23

Payments processor Virsympay, which serves small and medium-size businesses, launched a gateway that supports Google Pay and Apple Pay transactions along with conventional card and automated clearing house payments. Money transfer provider Paysend said Spanish-language content and media company TelevisaUnivision has become a shareholder in the company as part of a multiyear deal …

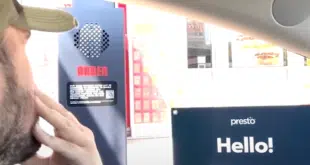

Read More »Presto Rolls Out Voice Ordering; SoundHound Integrates Voice Ordering With Oracle’s POS

Presto Automation Inc., a provider of artificial intelligence-based solutions for drive-through restaurants, is rolling out its voice-ordering system at participating Carl’s Jr. and Hardee’s drive-throughs nationwide. San Carlos, Calif.-based Presto had been piloting the technology at select Carl’s Jr. and Hardees locations. Carl’s Jr. and Hardees, which together have about …

Read More »Block Nears $5 Billion in Revenue

Buoyed by Cash App, services, and a move up market Block Inc., parent of Square and Afterpay, generated nearly $5 billion in first-quarter revenue, a 25% increase from $4 billion in the same quarter a year ago. Its transaction-based revenue of $1.42 billion was a 15% increase from $1.29 billion …

Read More »Shift4 Busies Itself with Domestic Expansion As It Waits for Clearance on Its Finaro Deal

Shift4 Payments Inc. is still waiting on approval from European regulators to complete its $525-million Finaro acquisition, but in the mean time the Allentown, Pa.-based processor has been busy expanding in its home market. That expansion includes yet other acquisitions aimed at consolidating Shift4’s grip on the restaurant point-of-sale market, …

Read More »Western Union Views Visa+ as Complement

The Western Union Co. says its decision to join the early set of providers in Visa Inc.’s interoperable peer-to-peer payments service called Visa+ reflects its business. Visa+ allows users to move payments between rival peer-to-peer payments networks. The pilot, set to launch later this year, will begin with transfers between …

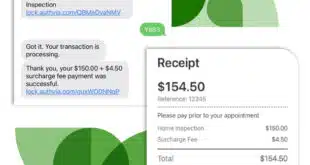

Read More »Fiserv Gives the Burgeoning Text to Pay Option a Big Boost

Fiserv Inc. has partnered with conversational-commerce platform provider Authvia to enable independent software vendors to offer a text-to-pay solution through Fiserv’s CardPointe gateway. The offering, which was developed in response to the growing use by businesses of tools to communicate with consumers via text and chat, allows businesses to bill, …

Read More »GoDaddy Joins With Microsoft to Enable Payments During Meetings on Teams

Businesses were quick to adopt online chat platforms as a handy meeting tool during the pandemic, and now payments providers are starting to target the services as a new venue for transactions. One of the first is GoDaddy Inc., which on Monday announced it is working with Microsoft Corp. to …

Read More »The Addition of Citi Flex Pay To Amazon Pay Could Be a Winner For Amazon and Citibank

Amazon.com Inc.’s deal with Citibank N.A. to add Citi Flex Pay, the card issuer’s installment-loan program, to its Amazon Pay digital wallet is expected to pay big dividends for both parties. By adding Citi Flex Pay, Amazon Pay will gain access to one of the largest cardholder bases in the …

Read More »