In four years, the Starbucks mobile-payment service, Apple Pay, Google Pay, and Samsung Pay, will continue to garner large shares of users, but not as much as they do today. That’s the forecast from research firm eMarketer Inc., released Tuesday. Of the four major mobile-payments services, Starbucks Corp.’s app will …

Read More »Eye on Transit: How Payment Convenience Could Boost Ridership; DART Updates Mobile App

It’s easy to see how convenience in the form of longer service hours and lower fares might increase ridership on public transportation systems, but new survey results show that mobile apps that combine various transit options, including payments, could also boost ridership. London-based mass-transit software developer Masabi Ltd. recently released results …

Read More »Ticketing App Atom Tickets Adds Landmark Theatres to a Stable of Major Movie Chains

The movie-ticketing app Atom Tickets has struck a deal with Landmark Theatres, said to be the country’s largest exhibitor of independent films, to add the company’s 53 theaters and 255 screens in 27 markets across the country. The deal will boost Atom Tickets’ coverage that includes more than 20,000 screens …

Read More »Payroll Firm ADP Adds Multiple Payment Options in its Wisely Pay Service

Payroll giant ADP LLC launched its Wisely Pay service Monday, which combines digital accounts and a Visa-branded chip card as ways to pay individuals and for them to access these funds. Wisely Pay is the first product resulting from Roseland, N.J.-based ADP’s October 2017 acquisition of Global Cash Card, a …

Read More »How Apple’s Goldman Gambit Could Help Lock in Banks Supporting Apple Pay

Apple Inc.’s move to create a new Apple Pay credit card with Goldman Sachs Group Inc. may or may not help boost usage of the mobile-payments service, but one thing it is likely to do is cement Apple’s ties with the thousands of banks that support the service, observers say. …

Read More »Early Ripple Cross-Border Tests Results and other Digital Transactions News briefs from 5/10/18

Blockchain provider Ripple Labs Inc. reported results on a number of pilots it is running for its XRapid cross-border payments network. Participants in the pilots have realized cost savings ranging from 40% to 70% compared to conventional fees. The average XRapid transaction took a little over two minutes, compared to two to …

Read More »Wells Fargo’s Mobile App Moves Payments to Center Stage, Even Before the Log-in

Ever since banks, merchants, and tech companies first introduced mobile services, they’ve looked for ways to entice more usage by streamlining the way consumers interact with little screens. Now Wells Fargo & Co. has decided to put frequently used payments services on the home screen of its mobile app, before …

Read More »The Same Old Problems Plague the ‘Pays’ As Adoption Levels Show ‘Signs of Slippage’

Ever since Apple Pay emerged in 2014, experts have scratched their heads over the general failure of contactless mobile wallets to catch on faster with U.S. consumers. Now comes research indicating how wallet sponsors might turn things around by focusing on what consumers are most looking for in wallet services …

Read More »Google Pay Coming to Browsers and other Digital Transactions News briefs from 5/4/18

Google announced that Google Pay users soon will be able to use the service to make purchases within the Chrome, Safari, and Firefox browsers. Once a card has been added to a Google Pay account, users don’t need to re-enter their payment info. If using Chrome, Google Pay can automatically …

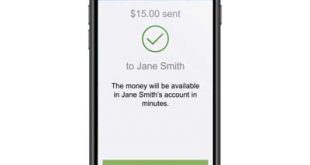

Read More »Beyond P2P: As Rival Venmo Moves In-Store, Zelle Eyes a Big Move on Disbursements

Since its official launch last June, Zelle has been all about carving out a healthy piece of the burgeoning person-to-person payments market for financial institutions. Now it’s promoting another service that leverages its network but could prove far more lucrative: disbursements. When companies, associations, or other organizations need to pay …

Read More »