Payments provider North American Bancard LLC said it has integrated its merchant processing platform with Visa Inc.’s Visa Acceptance Platform, allowing it to offer merchants access to Visa properties such as Cybersource, a fraud-detection platform. The Clearing House Payments Co. LLC said first-quarter volume on its RTP real-time payments network set a quarterly …

Read More »PayPal And Venmo’s Visa+ Entry Could Aid Interoperable P2P Payments

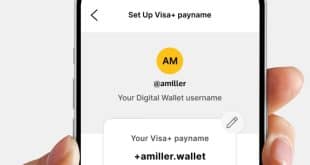

Enrolling PayPal and Venmo into the Visa+ interoperable peer-to-peer payments system may help foster even more P2P transactions, an analyst says. Visa Inc. earlier this week announced the two P2P wallets from PayPal Holdings Inc. had been enabled in the United States for Visa+. Users can sign up for a …

Read More »Lightspeed Makes Layoffs and other Digital Transactions News briefs from 4/3/24

Canada-based payments processor Lightspeed Commerce Inc. announced it will reduce its headcount by roughly 10%, or 280 jobs, and make other spending cuts in operations and facilities, in a cost-cutting initiative it expects to complete by the end of June. The company has not had a profitable year since going public in …

Read More »Nuvei Strikes a Deal With Advent International to Go Private

Nuvei Corp. announced early Tuesday it has entered into a definitive agreement with private-equity firm Advent International to be taken private in an all-cash deal valued at $6.3 billion. The deal comes less than a month after the Montreal-based processor announced it was fielding offers to take the company private. …

Read More »PayPal, Venmo Activate Visa+ and other Digital Transactions News briefs from 4/2/24

Visa Inc. announced PayPal and Venmo have activated Visa+, its interoperable peer-to-peer payments service that enables users in one P2P service to make a payment to another person using another network. Fintech Current and The Western Union Co. are expected to enable Visa+ next, Visa said. The service’s B2C payout capability has …

Read More »ACI Targets a Growing Digital Payments Market in the Middle East and Africa

ACI Worldwide Inc. announced early Monday it has signed a 10-year partnership with digital-payments technology provider Arab Financial Services. The deal is expected to accelerate ACI’s push to help financial institutions and fintechs in the Middle East and Africa modernize their digital-payments technology infrastructure, according to ACI. Under the terms …

Read More »With a Lower Cost and a No-Chargebacks Promise for Merchants, Pay by Bank Emerges as a Fiserv Priority

Pay by bank is not a new electronic-payments concept—consumers have been paying utility bills with their bank accounts for years—but the promise of lower fees and reduced merchant headaches is energizing the service, and work is at hand developing new use cases. Witness Radial Inc., an e-commerce platform adopting Link …

Read More »PayPal, Amazon, Apple, And Walmart Are Among the Big Winners in the Interchange Deal

The transaction-cost savings and tender steering provided for in the big interchange settlement reached earlier this week will be worth hundreds of millions of dollars annually for major merchants and the big mobile-wallet providers, according to estimates provided to Digital Transactions News by San Carlos, Calif.-based payments researcher Crone Consulting. …

Read More »COMMENTARY: The Great Hope Rising From the Quiet Revolution Against Card Payments

In the heart of America’s bustling commerce, a subtle yet powerful revolution is unfolding, driven by small merchants. The strategies of offering discounts for cash payments and imposing surcharges for card transactions are at the forefront of this change. These practices, rapidly gaining traction across communities, directly challenge the entrenched …

Read More »Usio Manages To Grow Revenues Despite a 26% Decline in Payment Volume

Usio Inc. pulled off a 19% increase in revenues and reduced its losses last year despite a 26% drop in total payment volume processed, according to a new financial filing from the merchant processor. San Antonio, Texas-based Usio provides payment-facilitator services, credit card processing, automated clearing house payments, prepaid card …

Read More »