It’s a big update day for users of Cash App, the money-movement service from Block Inc., as a new artificial-intelligence tool, a borrowing service, and cryptocurrency options are added.

Announced Thursday, the roster of 11 product updates to Cash App, which launched in 2013 as a person-to-person payment method called Square Cash, is notable because it’s the first bundled release of features for Cash App. Block uses a similar updating method for its Square point-of-sale suite. Block says Cash App and Square are foundational to its growth.

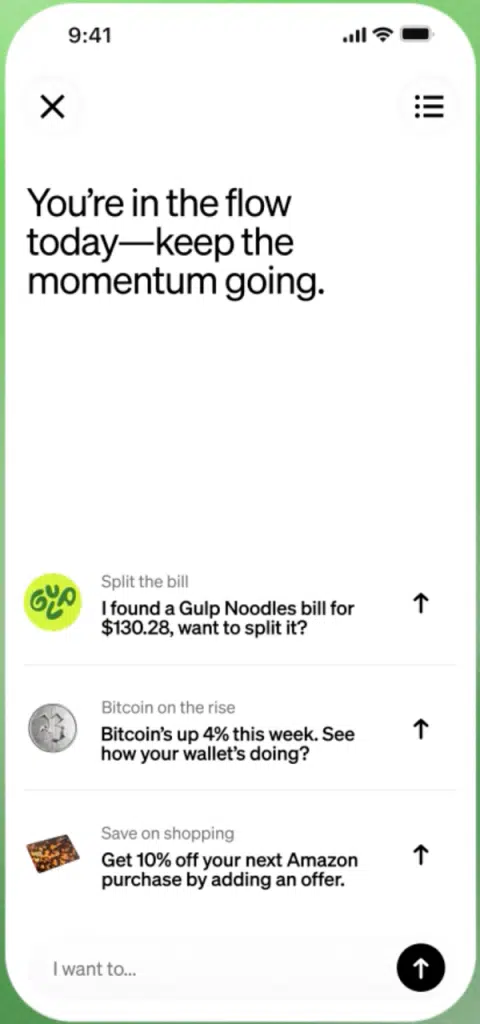

First up is Moneybot, an AI assistant tool that was developed as a way for Cash App users to navigate their finances, a Cash App spokesperson says. “It connects the dots between how customers spend, save, and invest—revealing the why behind every dollar and surfacing insights that help them stay on top of their finances,” the spokesperson says in an email to Digital Transactions News.

Many Cash App customers have multiple income streams or unpredictable paydays, the spokesperson says, which can complicate their budgeting. Moneybot is a way to help them get a better view of their spending, savings, and investing, Cash App says.

Moneybot, in limited release now but expected to be more broadly available in coming months, works only with Cash App transactions, funds, and accounts. And, to allay trust issues some consumers may have with AI, Moneybot’s actions are done at the direction of the user, the spokesperson says. “Moneybot never acts on its own, meaning customers are in control–every payment, transfer, or trade requires explicit confirmation before anything moves.”

The Moneybot tool also is not a financial-advice service. “Moneybot provides information, context, and educational insights to help customers make their own informed decisions, but it doesn’t give financial advice. It’s designed to empower customers with clarity—not to persuade or direct their choices—and is designed to align with Cash App’s standards for responsible, transparent communication,” the spokesperson says.

Moneybot responds to natural conversational commands from the user. A customer may prompt it with actions like “Send $500 to Reese for rent,” the spokesperson says, or to check the user’s weekly spending or ways to save money. “It learns from how customers use Cash App to offer proactive suggestions and real-time insights, and it helps them take action seamlessly.”

Cash App Borrow is now available in 48 states and in amounts up $500 for first-time borrowers. It is not available in Colorado or Iowa. Customers pay a one-time flat fee each time they use Cash App Borrow. Repayment is made by making weekly installment payments, paying the balance at one time, or as they receive funds into their accounts, Cash App says.

The updated Cash App also enables eligible users to pay with bitcoin. Beginning later in November, they will be able to select U.S. dollars as a currency option after scanning a Lightning QR code using their Cash App USD balance, without having to spend or hold bitcoin. Lightning is a network built on top of bitcoin that enables sending and receiving of the cryptocurrency with very small fees, according to the Kraken crypto exchange. Cash App also includes a map to find Square merchants that accept bitcoin.

Another new feature is a benefits program called Cash App Green that allows qualifying customers to earn benefits by either spending $500 or more per month through the Cash App Card or Cash App Pay, or by depositing $300 in qualifying deposits per month.

Cash App also makes it easier for users to view their Afterpay buy now, pay later activity in the app by eliminating the need for a separate app or login.