Network volumes and interchange revenues posted hefty increases at American Express Co. in the second quarter as consumers and businesses spent more while a recovery continues from the Covid-19 pandemic that hit two years ago.

AmEx reported Friday that its network volumes totaled $394.8 billion in the quarter ending June 30, up 25% from $316.1 billion a year earlier. U.S. spending, which accounts for 70% of the total, rose 24% while international volume increased 26%.

The higher spending powered a 30% increase in New York City-based AmEx’s discount revenue to $7.87 billion versus $6.04 billion in 2021’s second quarter. Further driving discount revenue was a slight increase in the worldwide average discount rate to 2.35% of the sale from 2.30% a year ago. Discount revenue is the company’s biggest revenue generator, with interest on its credit card and other loans second at $2.71 billion, up 29% from a year earlier.

The big increase in revenue grew praise from analysts Friday morning on a conference call with top AmEx executives. But one potential party spoiler is inflation, which lately has been running in the 9% range in the U.S. inflation’s impact is less on charge volume and more on expenses, according to chief financial officer Jeff Campbell.

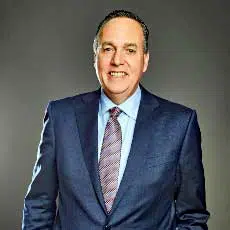

“Inflation, while driving some modest positive impact on volumes, is also putting pressure on our operating expenses, particularly in our compensation costs,” Campbell said. In addition, competition to find and keep top talent in a tight labor market is forcing AmEx to raise pay, according to Campbell and chief executive Stephen Squeri.

While acknowledging some inflation in the volume numbers, Squeri said on the call that “this spending is not inflation-driven.”

“The most important thing for us is we’re seeing an increase in transactions, and … what’s really driving our growth right now is an increase in overall transactions in our business,” he said.

While AmEx has broadened well beyond its original travel-and-entertainment base into retail and other merchant-acceptance categories, T&E remains a significant volume generator for the company. Campbell reported that T&E spending is now at 108% of 2019 levels, with restaurant billed business growth up about 40%. But lodging and airline volumes remain below pre-pandemic levels, which means plenty of potential transaction recovery remains, according to Squeri.

“We’re not at a normal level of T&E yet in our business,” he said.

Squeri also painted a picture of AmEx, which introduced its iconic Green card in 1958, as not your father’s credit card company. “Millennials and Gen Z consumers are a large part of our existing customer base and our fastest-grow[ing] age cohort, making up 60% of all new consumer cardmembers we’re acquiring,” he said. Squeri added that spending by that age cohort grew 48% in the second quarter, “significantly outpacing other generations.”

In all, AmEx reported $13.4 billion in second-quarter revenue net of interest expense, up 31% from $10.2 billion a year earlier. Net income fell 14% to $1.96 billion from $2.28 billion in the prior year’s second quarter thanks to a higher provision for potential credit losses.