Bank of America Corp. next year will enhance Erica, its popular digital financial assistant powered by artificial intelligence, with two new features—one to make its credit and debit card holders aware of which merchants might be storing their card numbers, and another that will issue alerts about possible duplicate charges.

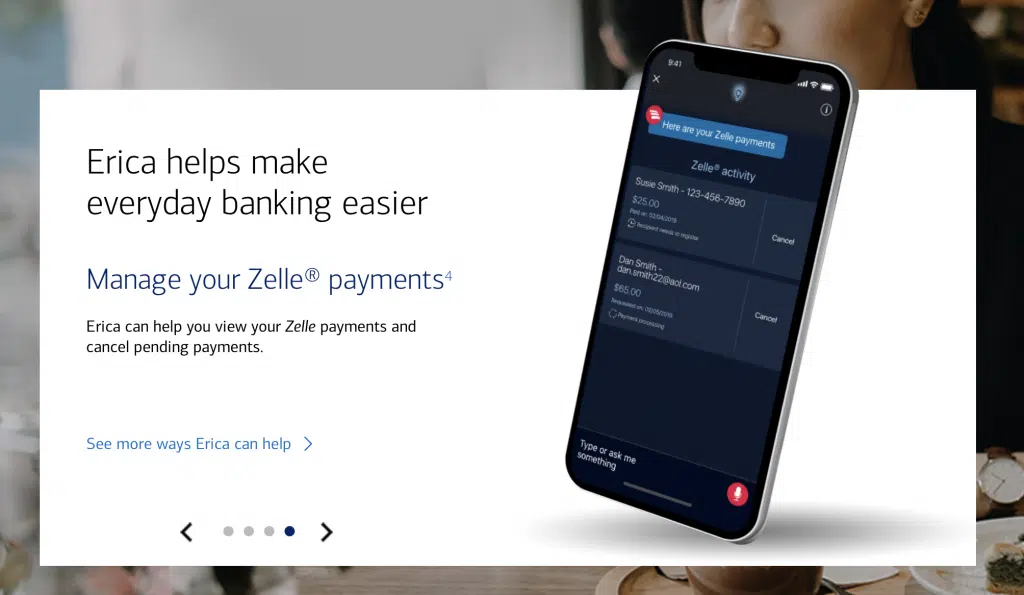

The Charlotte, N.C.-based mega-bank announced the new features Wednesday at the same time it revealed that Erica, launched just 18 months ago, now has more than 10 million users and is on track to complete 100 million client requests in the coming weeks. The service functions within BoA’s mobile app and is accessible by text, voice, or taps with gestures. Erica provides nuts-and-bolts banking information such as balances, but also enables customers to track spending, manage their Zelle person-to-person payments, get bill reminders, dispute credit card charges, and obtain other information.

Up next is what BofA calls “New Card Merchant List Assistance.” After the customer receives a replacement debit or credit card, “Erica will proactively provide clients a list of merchants and subscription services where their card information may be stored, making updates easier,” BofA said in a news release. “Clients can also ask Erica for a list of companies that have their card on file at any time.”

Also in the dock is “Duplicate Merchant Charges Insight.” Erica will alert customers when they might have been charged more than once for a purchase on the assumption they’ll want to take immediate action. The service will then guide them through the dispute-filing process, if needed.

BofA expects both enhancements to go live early in 2020. Another new Erica feature will keep customers informed of their progress if they participate in the bank’s Preferred Rewards program.

“Erica is ushering in a new era of personalized banking and providing our clients never-before-possible convenience,” David Tyrie, head of advanced solutions and digital banking at BofA, said in a statement. “Our high-tech capabilities together with our high-touch approach deliver a more intuitive and efficient banking experience for our clients across all channels.”

BoA said 60% or more of of its customers in 17 major cities are actively using its mobile app, and that it has 29 million mobile-banking customers. Memphis, at 65%, and Nashville, at 64%, in Tennessee lead the pack.