As e-commerce merchants look to make checkout faster and more convenient for a rising volume of online customers, e-commerce platform provider BigCommerce Holdings Inc. is partnering with Bolt Financial Inc., a developer of cloud-based checkout, payments, and fraud prevention solutions, to more quickly enable BigCommerce merchants of all sizes to add Bolt One-Click Checkout in a self-service manner.

BigCommerce merchants can add Bolt One-Click Checkout by connecting via the payment settings within the BigCommerce control panel without having to write or implement code.

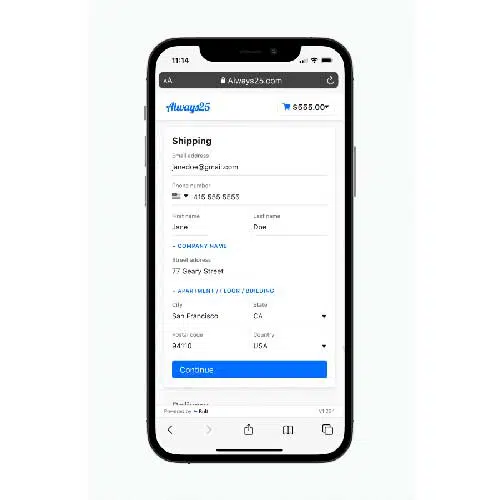

Bolt says a big advantage of its one-click checkout solution is that it enables one-click registration for first time shoppers in a merchant’s existing guest checkout flow, thereby automatically identifying known shoppers. As a result, online shoppers can move securely across a merchant’s site using a single identity and not be required to provide log-in and password information during the checkout process.

Integrating one-click checkout into their e-commerce sites enables BigCommerce merchants to keep their existing guest checkout, while taking advantage of the increased conversion rate enabled by Bolt’s built-in one-click checkout, Bob Buch, chief business officer for Bolt, says in a prepared statement. Indeed, the inclusion of one-click checkout can increase conversion by as much as 53%, according to BigCommerce.

“Shoppers expect a seamless checkout experience, whether they’re purchasing from a local boutique or a huge global retailer, so it’s crucial that these businesses provide the same quick, easy checkout that the biggest platforms do,” Buch says. “We’ve streamlined installation to make sure businesses of all sizes have nearly instant access to our network of tens of millions of shoppers.”

Bolt says merchants can leverage Bolt’s more than 160 pre-built integrations with payment processors, tax, shipping, and enterprise resource planning solutions, for example. Merchants need to connect to existing payment solutions to collect payments, BigCommerce says. Merchants can also gain business insights on network-driven transactions by logging into the Bolt dashboard to access such data as network-driven sales volume, account creation, and average order value.

“Expanding availability of Bolt to all of our merchants will enable those store owners to further refine and optimize their checkout and overall conversion rates strategies, while still preserving their access to the myriad payment and other technology partner solutions that they also want to deploy,” Russell Klein, chief commercial officer for BigCommerce says in a prepared statement.