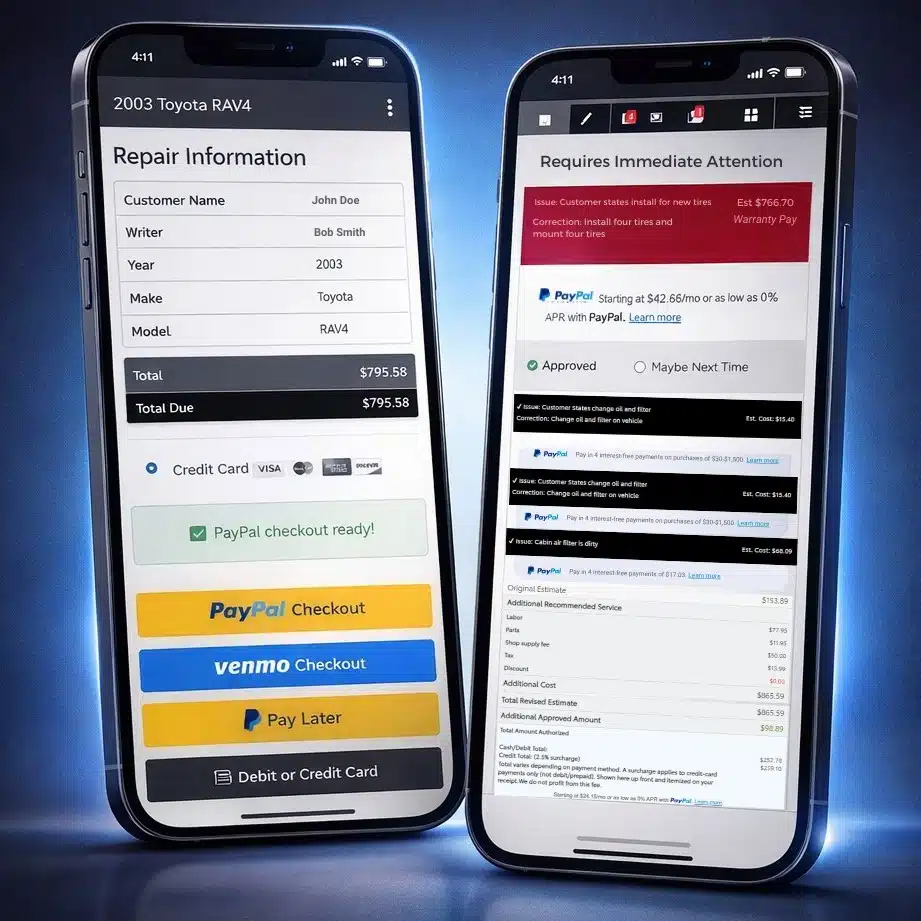

UpdatePromise, a software provider to automobile dealerships, said Tuesday it has agreed to integrate PayPal and Venmo to offer expanded payments capabilities in the service lane. The move comes as payments technology takes on increasing importance at dealerships looking to avoid snarled transactions while working out details with customers, the company says.

Chino, Calif.-based UpdatePromise says the two well-known payment methods will be offered as a fully integrated part of the normal service workflow, allowing payments to take place during the review of services performed rather than as a separate transaction. PayPal is a well-known payment method. Venmo, which PayPal acquired in 2013 as part of its $800-million deal for the processor Braintree, has grown into a method whose popularity has carried it beyond its origins as a peer-to-peer payment method.

PayPal reported Tuesday Venmo accounted for $85.8 billion in volume in the quarter ended Dec. 31, up 13% compared to the same period in 2024. PayPal as a whole processed $475.1 billion in volume for the quarter, a 9% increase.

For its part, UpdatePromise says popular payment methods like these lead to higher approval rates for service at dealerships while remaining relatively simple to process for car owners and staff. The adoption of the payment methods helps dealers “remove barriers at the point decisions are made” by customers, notes Curtis Nixon, UpdatePromise’s chief executive, in a statement.

Update Promise, founded in 2009, is one of several platforms that have lately made automobile dealerships a target market for consumer payments. Dealer Pay last month announced a capability for dealers to collect payments through text messaging or email.

And in October, Priority Technology Holdings Inc. announced an aggressive expansion into automotive servicing with the acquisition of DMSJV LLC, a payments provider whose services include surcharging to help dealers cover transaction costs.