Opponents of the proposed Credit Card Competition Act expect the bill will be reintroduced in Congress, so the Electronic Payments Coalition launched a pre-emptive strike late Wednesday with a report detailing the bill’s potential economic impact. The study, conducted by Oxford Economics Research, claims the CCCA’s impact on the U.S. …

Read More »Doxo Launches an All-In-One App Aimed at Removing ‘Fragmentation’ From Bill Payments

Bill-payment platform doxo Inc. has launched an app it says streamlines both bill payment and management and helps consumers avoid hidden costs, such as overdraft fees, when paying their bills. The app, called doxoBILLS, allows users to organize and pay bills to more than 120,000 billers and pay any …

Read More »Adobe Analytics: Online Holiday Sales Hit A Record High In 2024

Consumers spent a record $241.4 billion online from Nov. 1 to Dec. 31, 2024, an 8.7% increase from the same period a year earlier, Adobe Analytics reports. During this period, single-day online sales totaled more than $4 billion on 15 days, up from 11 days in 2023. Smart phones accounted …

Read More »Affinity FCU Partners With a Payments Fintech to Boost Financial Literacy

Affinity Federal Credit Union is working with fintech Greenlight Financial Technology Inc. to launch a financial-literacy program. The program will provide Affinity members and their families free access to Greenlight’s mobile app and debit card for kids and teens. The app allows parents to manage their child’s spending, send money, …

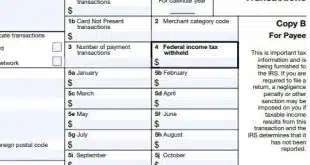

Read More »The IRS Rings in 2025 With New Reporting Requirements for P2P Networks

The Internal Revenue Service will begin requiring peer-to-peer payment apps in 2025 to issue 1099-K statements to self-employed workers who received more than $5,000 in payments through those apps in 2024. The new requirement, which is being implemented after a two-year delay, applies to such P2P apps as PayPal, Venmo, …

Read More »Merchants Hit Back at a Banking Group’s Request That the Fed Hold off on Reducing a Debit Interchange Cap

The Merchants Payments Coalition fired back late Monday at a request last week from the American Bankers Association that the Federal Reserve not act on a proposal to lower a longstanding limit on the interchange banks can earn on debit card transactions. In a letter to the Fed, the MPC …

Read More »An Injunction Against Illinois’s Interchange Act Leaves Both Sides Claiming Victory

United States District Court Judge Virginia Kendell granted a preliminary injunction late Friday that provides banks some relief from the pending Illinois Interchange Fee Prohibition Act, but also gives merchants reason to cheer. Kendell, who is overseeing a lawsuit filed against the IIFPA, ruled the injunction applies only to financial …

Read More »WooCommerce Makes Affirm Its Go-To BNPL Provider

WooCommerce is making Affirm Holdings Inc. its default buy now, pay later payment option, the e-commerce platform provider announced early Thursday. WooCommerce has offered Affirm as a payment option since 2015. In 2022, WooCommerce began offering Affirm to its merchants in Canada. As part of the deal, eligible merchants will …

Read More »Consumers Are Struggling to Pay Their Credit Card Bills on Time, J.D. Power Finds

Consumers may not be racking up more revolving credit card debt than they did in 2023, but their ability to pay their bills on time is coming under pressure, according to a report released early Thursday by J.D. Power. Consumers say they are having a harder time paying their bills, …

Read More »A CFPB Circular Warns of Illegal Rewards Practices; Shareholders Will Vote on the Cap One-Discover Deal

The Consumer Financial Protection Bureau early Wednesday released a circular to law-enforcement agencies warning that operators of credit card rewards may be violating a prohibition against unfair, deceptive, or abusive acts or practices by devaluing earned credit card points and airline miles. The CFPB issued the circular in part due …

Read More »