Worldpay Inc. early Monday launched its Authentication Optimization service, which uses artificial intelligence to make real-time decisions on whether to authenticate a transaction using 3D Secure or to directly authorize the payment using such factors as risk and issuer preference.

The service is being made available to merchants in non-3D Secure regulated markets, including the United States. 3D Secure is an authentication method that relies on an extra piece of information from the card user to verify the user’s identity during a transaction.

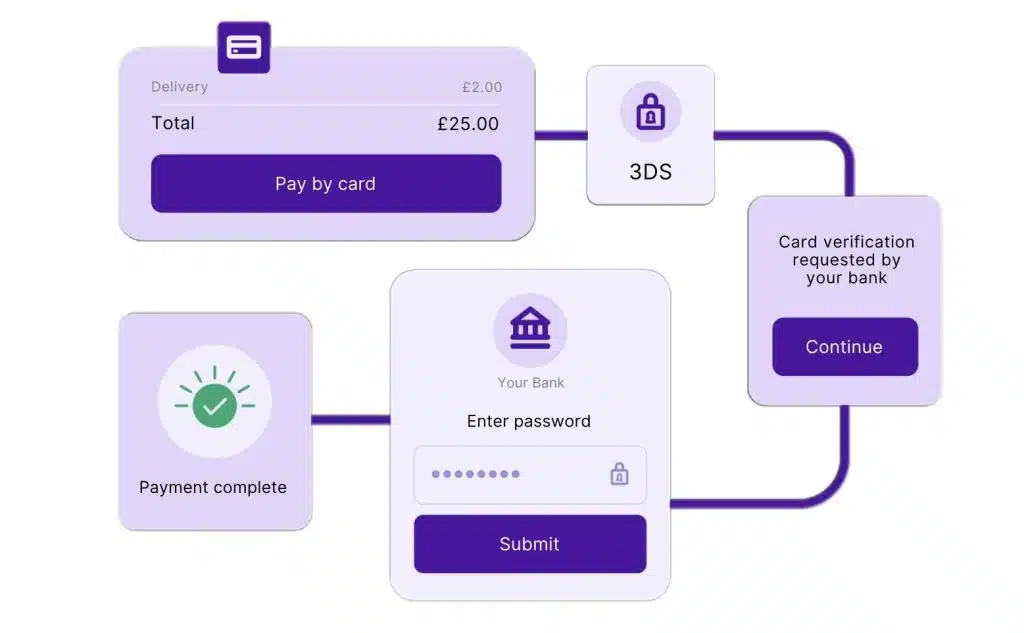

Unlike rules-based systems, which can be rigid in their decision making, Worldpay’s service continually learns and adapts to changing issuer and market behaviors, according to the processor. That flexibility enables the service to route transactions for 3D Secure (3DS) authentication only when truly necessary, such as for regulatory compliance or when Worldpay’s data indicates a high probability of issuer acceptance, the processor says. That approach “reduces unnecessary friction while maintaining security and compliance standards,” Worldpay adds.

During a two-month pilot, a cruise line that uses 3DS on all transactions saw a 5.5% increase in authorization rates, on average, according to Worldpay. In markets where strong consumer authentication is not required, the cruise line experienced double-digit increases in authorization rates.

In addition, the service has shown that, in instances where 3DS authentication is bypassed, the impact on fraud is nominal, with just one chargeback reported during a two-month period, Worldpay says.

Data-driven, adaptive tools “can help bridge the gap between merchant needs and issuer risk management, delivering better outcomes for everyone in the payments ecosystem,” James Mirfin, senior vice president, head of risk and identity solutions for Visa Inc., says in a statement.

While Worldpay’s authentication service could improve authentication rates in markets where consumer authentication is not required, merchants will have to decide whether the tradeoff between consumer authentication and the friction it creates is worth it, says Cliff Gray, principal at Gray Consulting.

“If 3D Secure is used as it is supposed to be, it is going to add some friction,” Gray says. “In the U.S., consumers are more averse to friction, because they want to tap and go. It’s up to the merchant then to determine if the tradeoff between friction and security is worth the risk” if it may cause a consumer to abandon the transaction.

Merchants likely to accept increased friction are those that generate high tickets. “On a high-ticket transaction, I’ve got a lot to lose,” Gray adds.