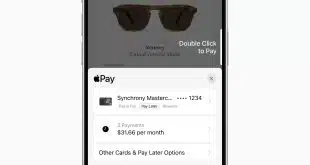

Apple Pay Later, the buy now, pay later product from Apple Inc. released just over a year ago, is shutting down. The move comes after installment-payment specialist Affirm Inc. confirmed it would be part of Apple Wallet when the tech giant’s annual software updates for iPhones and computers emerge this …

Read More »ACI Notes Cross-Border Milestone and other Digital Transactions News briefs from 6/18/24

U.S.-based payments provider ACI Worldwide Inc. said its partnership with Stet, a Paris-based clearing and settlement system, processed more than 50 million real-time cross-border payments in the past 12 months. The companies expect that volume to grow more than 50% in the current year. Cross-border payments specialist Nium Pte. Ltd. said it is working …

Read More »Eye on Ticketing: Shift4’s San Diego FC Ticket Win; Passport Preps for College World Series

A new soccer club in San Diego will use Shift4 Payments Inc. for its ticketing transactions, while Passport Inc. readies its parking expertise for the NCAA Men’s College World Series this week. Allentown, Pa.-based Shift4 says its payments technology will undergird ticket transactions for the new Major League Soccer team, …

Read More »Yardi’s Rent-Payment Integrations and other Digital Transactions News briefs from 6/17/24

Yardi Systems Inc. a provider of property-management software, announced integrations with two rent-payment platforms, Best Egg and Flex, in a move that the company says will enable tenants with a direct payment option through Yardi’s service. Online bill pay provider doxo Inc. launched the Cost of Bills Index, which is based on doxo’s …

Read More »The Big Credit Card Settlement Now Appears to Be Headed for a Trial. Who Will Win?

With the judge in the massive credit card interchange litigation apparently insisting on a trial, a new and unsettling element of uncertainty now hangs over the nearly 20-year-old case, in which merchants allege anti-competitive behavior by the big credit card networks in setting interchange fees. The latest development comes nearly …

Read More »Why Every Community Bank Should Offer Commercial Credit Cards

Community banks, known for their personal touch and deep community ties, face unique challenges and opportunities to deepen those relationships. Introducing commercial credit cards is a strategic decision that aligns well with their commitment to local businesses. Offering a best-in-class commercial card program meets the needs of local enterprises and …

Read More »Shift4 Closes Revel Deal and other Digital Transactions News briefs from 6/14/24

Shift4 Payments Inc. announced it has acquired a majority interest in Germany-based point-of-sale provider Vectron Systems AG in a transaction previously reported by Digital Transactions News. Vectron serves roughly 65,000 merchant locations throughout Europe. Shift4 also said it has closed on its previously announced deal for Revel Systems, a point-of-sale technology company serving more than …

Read More »CardFree Enlists AI To Get Consumers To Spend More

Everyone has encountered the upsell. It’s the extended-warranty offer when buying a TV, or the ask to add a Danish to the coffee you just purchased. Now, CardFree Inc. has released a tool to help merchants automate the upsell with its new Smart AI Upsell feature. A component of CardFree’s …

Read More »Looking to Snag Millennials and Gen Zers, eBay Adds Venmo

EBay Inc. is recruiting Venmo as a payment option, the big e-commerce marketplace announced early Thursday. The move, which comes about a week after eBay announced it will no longer accept American Express cards effective Aug. 17, is part of a strategy to add alternative payment options that appeal to …

Read More »Men Are Now the Primary Buyers of Gift Cards, Blackhawk Network Finds

Men have supplanted women as the primary buyers of gift cards, says a report from Blackhawk Network. The shift is attributable to men taking on more household responsibilities, such as shopping and gifting, the report says. Blackhawk has been conducting the survey for nearly a decade. Types of gift cards …

Read More »