Zip Co. Ltd. said its payments services are available for U.S. merchants through checkout services managed by Stripe Inc., including Elements, Checkout, and Payment Links. Fintech Everyday People Financial Corp. has agreed to manage network-branded card and digital-wallet programs offered by XTM Inc., a provider of real-time payments and earned-wage access, in a deal …

Read More »Eye on BNPL: Splitit Adds Debit Cards as BNPL Funding Source; Affirm Expands Worldpay Partnership

Buy now, pay later providers continue to make inroads in payments, with Splitit Payments Ltd. integrating a service to make it easier for banks to offer their customers installment plans at checkout. Meanwhile, Affirm Holdings Inc. expanded how it works with processor Worldpay LLC by integrating its BNPL service into …

Read More »Wayfair Adds Affirm In-Store and other Digital Transactions News from 10/21/25

Buy now, pay later specialist Affirm Holdings Inc. expanded its partnership with retailer Wayfair Inc. to include in-store transactions. Wayfair initially adopted Affirm in 2016 for online checkout. First Internet Bank adopted Zelle, a peer-to-peer payment service, for its business customers. Payment orchestration platform Gr4vy Inc. completed an integration with the new Mastercard Merchant Cloud, a payments platform …

Read More »UATP Teams With Burbank to Turn Online Payments into Card Present Transactions

Universal Air Travel Plan Inc. (UATP) early Thursday announced it has partnered with Burbank, a United Kingdom-based fintech, to deploy an app that enables mobile devices to act as a POS terminal to process card-present transactions over the Internet. The app is embedded in the merchant’s mobile app, which …

Read More »FIS Smart Basket Coming and other Digital Transactions News briefs from 10/16/25

Processor FIS Inc. said it will soon release Smart Basket, technology designed to automatically optimize rewards and payment methods at checkout. Mastercard Inc. and Visa Inc. reached a proposed settlement of $199.5 million in a class action lawsuit a group of merchants filed almost 10 years ago, Reuters reported. The settlement still requires …

Read More »Stablecoins Remain Hot As Banks Vie For Issuance And Related Services

Action in the payments industry on stablecoin plans appears to be perking up since President Donald Trump signed the GENIUS Act into law this summer, legislation whose rules are expected to spark more action by mainstream payments players on issuing and accepting the digital currency. One example emerged Wednesday with …

Read More »$45.5 Trillion in Card Purchases and other Digital Transactions News briefs from 10/9/25

New research from Datos Insights found that credit and debit cardholders globally made 1.1 trillion purchases worth $45.5 trillion in 2024. Buy now, pay later provider Splitit launched its Agentic Commerce Partner Program, an invitation-only effort to bring card-linked installment payments to autonomous shopping agents. Some 86% of restaurant operators are comfortable with the …

Read More »COMMENTARY: Visa’s New Commercial Enhanced Data Program: What Merchants Need to Know

Merchants are no strangers to rising payment-processing costs. Merchant-processing fees often feel unavoidable, driven by interchange rates and card-network rules that are beyond a merchant’s control. However, in April 2025, Visa introduced a program that could reshape how merchants manage these costs: the Commercial Enhanced Data Program, also known as …

Read More »Klarna Tops 1 Million Cards and other Digital Transactions News briefs from 9/25/25

Klarna AB said more than 1 million consumers have signed up for its Klarna Card since the product debuted in the U.S. market July 4. The daily signup rate for the debit card reached 50,000 on Tuesday. The news follows the company’s announcement last month that it has become an in-store payment method …

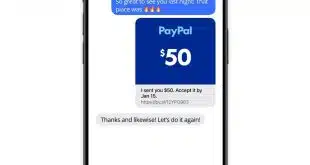

Read More »PayPal Broadens Its Peer-to-Peer Payments with PayPal links

Peer-to-peer payments competition has increased with the debut of PayPal links, a new way for PayPal users to send funds to others. PayPal links enable users to create a personalized link to share that contains the amount and a short description. PayPal says they can be shared in any conversation, …

Read More »