Early in the COVID-19 pandemic, retailers shifted focus to e-commerce. Despite the world gradually returning to in-person experiences, online shopping continues to grow exponentially.

In fact, the e-commerce industry is projected to grow from $4.28 trillion this year to $6.39 trillion in 2024. With more people online shopping, the demand for a smooth shopping experience has skyrocketed.

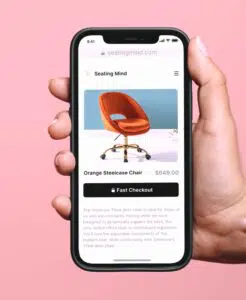

Fintech startup Fast caught on to that trend and aims to solve friction at checkout for consumers and cart abandonment for merchants. With Fast Checkout – Fast’s one-click checkout button – merchants offer their consumers a payment option that takes seconds to complete for pain-free, secure purchases.

Fast recently landed some of its largest merchants to date, including outdoor cooker producer Big Green Egg, exercise equipment company Kettlebell Kings, and performance racing parts supplier Vivid Racing. Fast touts huge returns from its longer-held accounts: Snow sports company Ski Haus’s conversion rate increased 174% after installing Fast Checkout, and Leather goods retailer Saddleback Leather‘s conversion rate increased 65%.

Fast Co-Founder and CEO, Domm Holland, got the idea for the checkout button when his wife’s grandmother forgot her password and couldn’t order groceries for the family online.

“I set out to solve that problem,” Holland said. “The concept behind it is really to make commerce easier for consumers – whether it’s the 70-year-old granny in Australia or the 20-year-old guy in San Francisco.”

Consumers only login once – which is when they sign up for Fast Checkout. Afterwards, to make a purchase, they just click the Fast Checkout button, and their order will be shipped automatically. No remembering passwords, no re-entering payment information.

Merchants can add the Fast Checkout button anywhere on their site. Most businesses place the button on their product detail pages for optimal conversions, Holland said.

“We see the biggest gain on the product page,” he said. “Over half of Fast transactions come from the product page, which is an incredible stat given that 99% of all merchants don’t even have checkout functions on product pages.”

Fast has several popular features, but two stand out in particular: order batching and headless checkout.

Order batching

Some merchants are hesitant to add a checkout button on product detail pages, Holland said. Merchants fear consumers would only buy one product and leave the site, decreasing average order value, or make multiple single-item purchases, which would increase shipping costs for both the consumer and business, he explained.

To combat those risks, Fast batches consumers’ multiple orders made within minutes of each other into one transaction.

“We avoid every single problem that every other checkout button encounters on the product page, and consumers have the ultimate, most frictionless checkout experience,” Holland said. “Fundamentally, order batching has been core to almost all of our growth to date as a business.”

Headless checkout

Fast’s other major feature is headless checkout, which allows merchants to place the Fast Checkout button off their websites and anywhere in the world. That includes in emails, blog posts, news articles – even billboards and print catalogues, with the help of QR codes.

“We’re exposing checkout to everybody who looks at a product, not just the people who actually click ‘Add to Cart,’” Holland said. “By doing this, we turn every marketing channel into a transaction channel. For a large enterprise, this is absolutely key because affiliates are a big source of revenue.”

Over the next year, Holland believes enterprises will start paying more attention to monetizing content across platforms.

“This is what we do today,” he said. “This is what headless checkout powers today.”

Kat is a freelance writer covering B2B SaaS and e-commerce in Detroit, Michigan.