As merchants continue to evolve their business model during the Covid-19 pandemic, they are discovering that consumers want convenience and multiple options when it comes to paying for purchases.

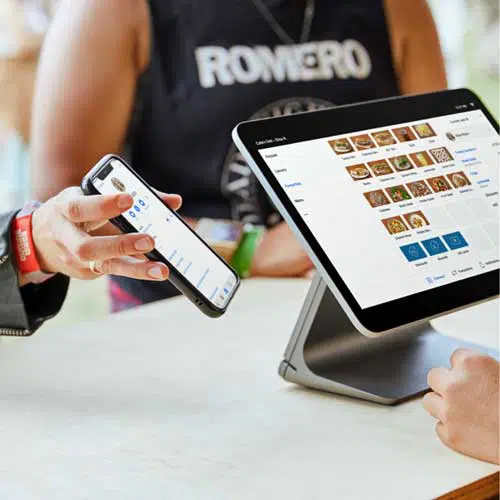

While credit cards remain consumers’ preferred method of payment, contactless options are a close second, according to Square Inc.’s second annual “The Future of Commerce Report,” released Wednesday.

According to the report, 36% of consumers prefer to pay using a contactless option, compared to 42% for conventional credit card transactions, while 9% prefer to use a mobile wallet. Overall, 77% of merchants surveyed offer contactless payments. Among the types of contactless payment options offered by merchants, mobile wallets top the list (63%), followed by touchless card payments (44%), and QR codes (25%). Overall, 31% of consumers surveyed say they want merchants to keep offering contactless-payment options after the pandemic subsides.

Square conducted the study—which surveyed consumers in the United States, as well as restaurateurs, retailers, and beauty merchants—with Wakefield Research. In addition, Square says it gathered insights from businesses and industry experts.

Contactless payments are proving popular with Millennials and Gen Zers, with 50% of consumers in those demographics stating a preference for contactless payments, says Square, which earlier this month announced it will be changing its corporate name to Block Inc. effective Dec. 10.

Among Gen Zers, paying with a mobile wallet is nearly as popular as paying with a credit card, with 21% saying they prefer to pay using a mobile wallet, compared to 24% stating a preference for paying with a credit card.

When it comes to how consumers shop, e-commerce is a go-to channel as consumers are making 37% of their monthly purchases online, according to Square. Consumers’ preference for online shopping has shifted retailer’s revenue stream, with retailers saying 58% of their sales, on average, come through the online channel.

While 64% of shoppers prefer an online order to be delivered to their door, 26% prefer to order online and pick-up in-store. Nearly half (47%) of retailers surveyed now offer buy online, pick up in-store.

Curbside pick-up is also gaining momentum, with 11% of consumers saying they prefer that option. Among Gen Zers, that figure jumps to 17%. Overall, 39% of consumers say they want to see curbside pick-up remain as a payment option after the pandemic subsides.

Consumers are also showing an inclination for self-service ordering technology when dining out. Indeed, 79% of consumers say they’d prefer to order food and drinks via self-serve kiosks rather than directly through staff. Consumer preference for self-service ordering extends beyond quick-service restaurants, with 45% preferring to use a self-serve kiosk when eating at a fast-casual restaurant, and 21% preferring to order through a kiosk for fine dining.