Consumers have flocked to buy now, pay later services, but providers still have to find ways to stand out. Afterpay Ltd. hopes to do that by enabling consumers who have a Rakuten account to earn cash back in the Rakuten program.

Announced Monday, the Afterpay program enables Afterpay users who also enroll in the Rakuten service to earn cash that can be paid out as a check or to a PayPal Holdings Inc. account.

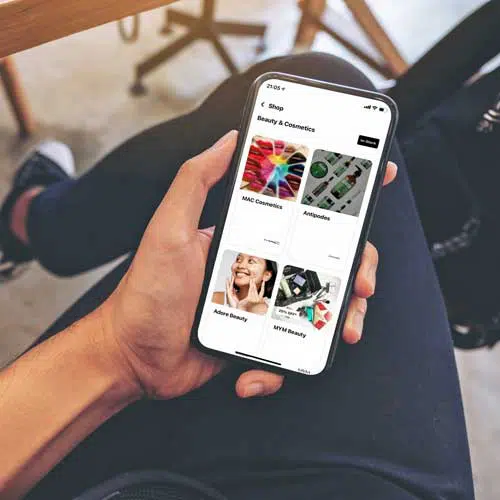

Australia-based Afterpay, which has U.S. headquarters in San Francisco, says it wants to encourage consumers to take advantage of both services when they shop at participating retailers, a spokesperson says. Among participating merchants are MAC Cosmetics, Crocs, Ulta Beauty, Urban Outfitters, and Ray-Ban. The rates for earning cash back will vary by merchant, as it typically does for consumers using Rakuten.

“This is the first time that Afterpay and Rakuten are coming together to stack the power our platforms, and communicate the combined benefits to both retailers and consumers,” the spokesperson says.

“Cash back and buy now, pay later are proven strategies for helping brands attract high-value shoppers and increase their sales,” Afterpay says in a statement. Rakuten says cash back enjoys universal appeal among consumers, not just among “habitual coupon cutters.”

PayPal, too, provided more evidence of the sensational growth of BNPL. Chief executive Dan Schulman said the company’s Black Friday BNPL sales were up 400% year-over-year. In a Reuters report, Schulman also said more than 9 million consumers have used the PayPal BNPL service. Of them, more than 1 million were first-time users in November. PayPal launched its Pay in 4 BNPL service in August 2020.