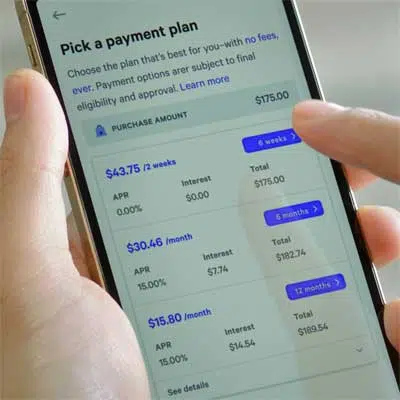

Capchase, which provides funding to software-as-a-service companies without requiring them to give up an ownership stake, has launched a buy now, pay later financing option that allows SaaS vendors to collect the full contract value for their applications while providing customers with flexible payment terms.

Capchase developed the BNPL payment option to address the financial burden SaaS developers face: paying high upfront research and development, and sales and marketing costs, while their customers typically want to pay monthly. Research by Capchase shows that over the past year more than 50% of SaaS companies experienced an increase in sales cycle length and customer payment delays, and about 40% of companies increased their collection times as a result. With Capchase’s BNPL offering, SaaS vendors can increase their working capital and accelerate revenue growth, while making products and services more accessible and easier to pay for, which can drive sales, increase revenue, and shorten sales cycles, the company says.

“Every buyer wants to pay as late as possible, while every SaaS company wants to get paid as early as possible so they can recover their customer acquisition costs,” Capchase chief executive and co-founder Miguel Fernandez says in statement. “In any of the payment options, one party is playing bank, which creates friction and hurts conversion. With Capchase Pay, we’ve created a B2B version of a buy now, pay later product that aligns with everybody’s interests.”

In related news, BNPL provider Affirm Holdings Inc. subpar financial performance continues. Affirm reported an operating income loss of $310 million for the third quarter of its 2023 fiscal year, up from a $227 million loss compared to the same period a year ago. Revenue less transaction costs totaled $167 million for the quarter, down from $182 million from the same period a year earlier, a 9% decline.

Revenue for the BNPL provider totaled $381 million, up 7% from the same period a year earlier, while active merchants increased 19% to 247,000 for the quarter, up from 207,000 a year earlier. Consumers actively using Affirm totaled 16 million for the quarter, up from 12.7 million a year earlier, a 26% increase. Transactions per active consumer increased 34% during the quarter compared to a year ago. During the quarter, 88% of the transactions made were made by repeat customers, Affirm reported.