Even though credit card spending is still depressed as a result of the Covid-19 economic downturn, payment card volume trends have now been improving for a month or more, according to new data from credit-union service organization PSCU. St. Petersburg, Fla.-based PSCU reported Monday that overall credit card spending by …

May, 2020

-

15 May

Retail Sales Slump 16% in April and other Digital Transactions News briefs from 5/15/20

The U.S. Commerce Department’s Census Bureau issued advance estimates for April’s seasonally adjusted retail and food-services sales totaling $403.9 billion, down 16.4% from March and off 21.6% from April 2019.In one indication of the toll the slumping economy is taking on consumers, store card issuer and processor Alliance Data said its overall delinquency rate …

-

14 May

Mastercard Says New Data Show Spending Headed Toward ‘Normalization Phase’

New network data from Mastercard Inc. show U.S. switched volume is off 6% year-over-year for the week ending May 7 compared with a 26% decline in the week ending April 30. Mastercard on Thursday released two more weeks of network data, for the weeks ending May 7 and April 28, …

-

14 May

In the Time of Covid-19, Risk And Underwriting Practices Must Adapt, Experts Say

Payments providers and acquirers are having to quickly adjust to evolving risk practices as chargeback volume and return rates change during the nationwide Covid-19 containment. That’s important because the Federal Trade Commission, in particular, is using these two metrics as potential indicators of misdeeds, advised panelists Wednesday in the “Regulatory …

-

14 May

Discover Postpones Fuel-Pump EMV Shift and other Digital Transactions News briefs from 5/14/20

In line with previous decisions from Visa Inc. and American Express Co., Discover Network said it is postponing its deadline for EMV capability at gas pumps to April 16, 2021. The original deadline was Oct. 16.Micro Merchant Systems, a provider of pharmacy technology, launched a service that allows patients to make contactless copays by …

-

13 May

Get Ready for the ‘Global Reset’ in Payments Spurred by Covid-19

The world’s response to Covid-19 already has accelerated trends underway in the payments business, and pandemic-spurred innovations will continue after the contagion eases, according to three senior industry executives. “The impacts of Covid-19 represent a true global reset of the entire market, not just our payments market,” said Philip McHugh, …

-

13 May

40% of Consumers Pledge To Shop Online More and other Digital Transactions News briefs from 5/13/20

Amid stay-at-home and social-distancing orders, 40% of consumers say they will shop online more in the future than in-store, while 45% are using a mobile wallet and 16% are using paper currency less, according to a survey of 1,030 consumers by Fidelity National Information Services Inc. (FIS). Some 31% will use …

-

12 May

Eye on Acquirers: ‘Signs of Hope’ for Restaurants; ISO Parent Newtek Funds $700 Million in PPP Loans

Merchant processor Shift4 Payments LLC reported Monday it has seen a big jump in restaurant payments in the past week, and the parent company of independent sales organization Newtek Merchant Solutions says it has approved and funded $700 million in loans to small businesses under the federal government’s Covid-19 relief …

-

11 May

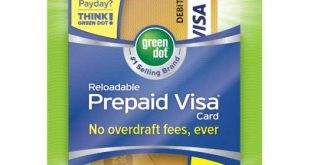

Green Dot’s New CEO Sees Its Bank as Key to Overcoming the Challenge from Challenger Banks

Green Dot Corp. chief executive Dan Henry has only been on the job for about six weeks, but on Monday he was emphatic about one thing: The prepaid card and payments specialist is going to hold on to one particular and—in the view of Henry—very valuable asset. “We are not …

-

11 May

Eye on Merchants: Debit Spending Increases And Clover Adds Online Ordering

The Covid-19 impact continues to make itself known in the payments arena. Consumers are increasingly favoring debit cards, especially now that many have received $1,200 stimulus payments. And merchants using the Clover point-of-sale system now have access to online ordering on the platform. Consumers increased their debit card spending 6.6% …