Acquirers wanting to tap into the ever-growing number of e-commerce merchants, especially small businesses, might do well to target a handful of U.S. cities with large bases of retail entrepreneurs. E-commerce platform provider Volusion released this week a list of the top 10 cities based on volume of merchants and …

August, 2017

-

11 August

Consumer Credits Hits Record and other Digital Transactions News briefs

Consumer revolving credit outstandings, most of which are credit card debt, hit a record $1.02 trillion in June, the Federal Reserve reported this week. The new high is 0.1% higher than the old record set in April 2008, just as the financial crisis of 2008-09 was gathering steam. Relying on leaked …

-

11 August

In a Surprise Move, the DoJ Asks the Supreme Court Not to Take AmEx Steering Case

In a brief filed Aug. 7, the U.S. Department of Justice has asked the Supreme Court not to take up an appeal over a lower-court ruling upholding a so-called steering practice by American Express Co. The DoJ, which in 2010 joined 17 states in suing AmEx over the practice, argues …

-

10 August

There Are As Many as 500,000 U.S. ATMs Now, Says ATMIA

The estimated number of U.S. ATMs—including those deployed by financial institutions and independent operators, and branded machines—increased 10.5% to at least 475,000 and as many as 500,000, the ATM Industry Association said this week. The previous estimate, released in 2015, was 430,000, says David Tente, ATMIA’s executive director for the …

-

10 August

Looking to Expand Its Lending Capacity, PayPal Strikes a Deal to Buy Swift Capital

The financial crisis of 2007-09 forced many banks to retreat from small-business lending, leaving a gap that digital-payments companies have rushed to fill. The latest move in this direction came Thursday, when PayPal Holdings Inc. said it has a deal to buy Swift Financial Corp., a Wilmington, Del.-based lender founded …

-

10 August

Cyberattacks Doubled in Just Two Years, Authentication Provider Says

ThreatMetrix Inc., a provider of digital-identity and authentication services, reports that its network detected and stopped 144 million cyberattacks in the second quarter, a 100% increase from 2015’s second quarter. ThreatMetrix says its Digital Identity Network from April through June also stopped 300 million bot attacks in which hackers take …

-

10 August

ISO To Resell CardFlight Card Reader and other Digital Transactions News briefs

Mobile point-of-sale services provider CardFlight Inc. announced that payments provider Central Payment will offer CardFlight’s SwipeSimple mPOS reader to merchants. Fidelity National Information Services Inc. (FIS) said home-improvement retailer Lowe’s will use FIS’s BizNOW prepaid service—labeled as Lowe’s PreLoad—to enable contractors to automate their purchasing activities, eliminating the need for their employees to …

-

9 August

Vantiv To Take Worldpay’s Name In a Merger That Will Create a Global Acquiring Powerhouse

After two delays, processor Vantiv Inc. and London-based merchant acquirer Worldpay Group plc finally announced a formal deal Wednesday that has Vantiv acquiring Worldpay in a deal that creates a global processing powerhouse. The cash and stock deal values Worldpay at $12 billion, a 34% premium to Worldpay’s six-month volume-weighted …

-

9 August

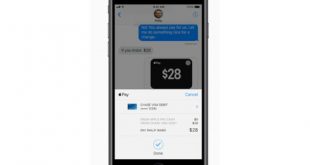

Green Dot Provides Some Details About its Role in the Upcoming Apple P2P Service

Prepaid specialist Green Dot Corp. released more details about its role in Apple Inc.’s upcoming person-to-person service in its Messages app. Apple announced the new feature in June and is expected to make it available this fall with an update to its iOS software for iPhone and iPads. Pasadena, Calif.-based …

-

9 August

Less Cash Use Triggers ATM Contract Re-Bid and other Digital Transactions News briefs

Declining use of cash at Atlanta’s Hartsfield-Jackson International Airport has prompted the Atlanta City Council to re-bid a contract for banking services at the world’s busiest airport after only one bank, SunTrust, responded to the original proposal, the Atlanta Journal-Constitution reported. The incumbent, Wells Fargo, claims ATM revenues have declined and that its …