Best known for its big fleet-fueling card business, WEX Inc. lately is getting stronger growth from its two other segments, health-care and employee benefits and corporate and travel services. WEX reported Thursday that total fourth-quarter purchase volume grew 8.4% to $20.1 billion from $18.5 billion a year earlier. Portland, Maine-based …

February, 2020

-

13 February

With Expanded Merchant Business Thanks to Worldpay, FIS Seeks to Exploit Its Acquiring Chops

When Fidelity National Information Services Inc. closed on its $43 billion acquisition of Worldpay Inc. last summer, the payments industry knew the massive deal would boost FIS instantly into the top ranks of global merchant processors. On Thursday, the company let the world know just how big its position in …

-

13 February

WooCommerce Adds CBD-Specific Features and other Digital Transactions News briefs from 2/13/20

E-commerce platform WooCommerce said it is offering CBD-selling merchants new services for monitoring security issues, printing shipping labels, and automatic tax calculation.Acadia POS and merchant-services provider GCG Consulting Inc. said they handled nearly 50,000 transactions on 77 PAX Technology point-of-sale devices at the recent Waste Management Phoenix Open.Business-payments firm Biller Genie said its clients are …

-

12 February

The New Global Payments Looks to Value to Offset Impending Visa Rate Changes

News of impending interchange-rate revisions from Visa Inc. may have roiled the payments industry, but for processing giants like Global Payments Inc., the impact will simply be business as usual. Top Global executives made that point crystal clear Wednesday. “We see these [rate changes] all the time. We have to accommodate …

-

12 February

PayPal Funds Firearms Payments Research and other Digital Transactions News briefs from 2/12/20

PayPal Holdings Inc. said it and the Center on Crime and Community Resilience at Northeastern University, along with the University of Chicago Crime Lab, formed a research project to examine payment methods used to finance illegally-sourced firearms with the goal of combatting the illegal sale of guns.Processor Fiserv Inc. announced its “Scan to …

-

11 February

RILA Calls for Action on the Fed’s Debit Cap As Powell Testifies Before Congress

Federal Reserve Board chairman Jerome Powell is testifying before Congress this week, and mixed in with questions and answers about interest rates, economic growth, and employment could be queries about when the Fed is going to update its cap on the fees issuers can charge for debit card transactions. At …

-

11 February

Repay Expands Its Footprint with Ventanex Acquisition

Payment-services provider Repay Holdings Corp. continued its run of acquisitions Monday when it announced it bought Ventanex for up to $50 million. Ventanex is an integrated-payments provider operating in consumer finance, especially mortgage-loan servicing, business-to-business health-care payments, and some other segments. Founded in 2012 and based in the Dallas suburb …

-

11 February

Mastercard Forms a Joint Venture To Clear Domestic Chinese Card Transactions

Mastercard Inc. is the latest U.S. payments company to take initial steps to operate in China with Tuesday’s announcement it will form a joint venture with NetsUnion Clearing Corp. to establish a domestic bank card clearing entity. The entity formed from the joint venture—Mastercard NUCC Information Technology (Beijing) Co. Ltd.—received …

-

11 February

RILA Urges Lower Durbin Debit Cap and other Digital Transactions News briefs from 2/11/20

The Retail Industry Leaders Association issued a statement calling on Congress to press Federal Reserve Board chairman Jerome Powell to “set a true rate” for debit card transactions that would reflect the intent of the Durbin Amendment to the Dodd-Frank Act. The amendment regulates debit card transaction pricing for large issuers. Powell is scheduled …

-

10 February

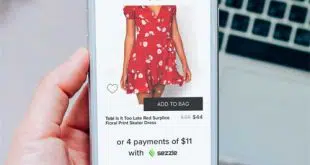

Eye on Fintechs: Sezzle Sizzles With 1 Million Users and Curve Opens a U.S. Office

Buy-now-pay-later specialist Sezzle Inc. said it surpassed 1 million consumers using its online payment service. Launched in 2016, Sezzle said it had reached 500,000 customers only in August 2019. At the end of the fourth quarter, the company, with corporate headquarters in Australia, said more than 10,000 merchants offer its …