Younger consumers are more likely to combine an in-store visit and online product research or purchases than their older counterparts. That’s one finding from the FutureBuystudy released Tuesday by GfK, a Germany-based research firm. The study, which examined U.S. consumer buying behavior, found that 46% of consumers between 18 and 26 …

Read More »Varo Money Readies ‘Val,’ a Bot Aimed at Helping Millennials With Money And Banking

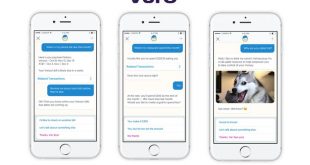

Chatbot developer Kasisto Inc. has agreed to provide a so-called smartbot for Varo Money Inc., a San Francisco-based provider of a mobile-only banking app. Both the app and the bot are in beta testing and expected to launch early next year. The new bot, called Val, is based on conversational …

Read More »Payments IPOs Plunge in 2016, but 2017 Could See Some High-Profile Offerings

After an active 2015 in which such prominent payments-industry firms as processor First Data Corp. and merchant acquirer Square Inc. completed initial public offerings of stock, 2016 saw little IPO activity by payment firms. But 2017 could be a different story, according to an analyst. The most notable new U.S. …

Read More »Events Gaining Cashless Payments Ability and other Digital Transactions News briefs

• Payment provider CardConnect released a beta version of Bolt P2PE, its cloud-based API terminal service that enables software companies to integrate their applications with PCI-validated point-to-point encryption and EMV devices for card-present transactions. • Wizard World Inc., producer of such pop culture events as Comic Con, is working with Front Gate Tickets for …

Read More »Updates From NFC Forum Include Ability to Show Tickets When Smart Phone Is Off

The NFC Forum, the Wakefield, Mass.-based organization that supports near-field communication technology, on Monday announced updates to three technical specifications and introduced a “candidate” spec. NFC is the technology most often used, for example, to link mobile wallets with point-of-sale terminals. One update, to “NFC Controller Interface (NCI) Technical Specification Version 2.0,” …

Read More »The Proliferation of Chatbots for Payments And Banking Begins to Raise Security Questions

An offshoot of artificial-intelligence research, chatbots emerged in 2016 as a popular technology for reaching and serving consumers for banking, payments, and shopping. Facebook’s Messenger app, which began supporting the bits of code this spring, was by September already crawling with 30,000 bots holding conversations with consumers to fulfill simple …

Read More »Mobile In-Store Payments Poised for Growth and other Digital Transactions News briefs

• Mobile in-store payments will total $91.7 billion by 2020, up from $18.7 billion this year, according to a report from Javelin Strategy & Research. Browser-based and in-app mobile payments, however, will dwarf that number, reaching $318.8 billion, nearly doubling 2016’s $161.3 billion. • Movie-ticketing platform Atom Tickets will integrate JPMorgan Chase & …

Read More »A Cross-Border Payments Startup Promises to Make the Blockchain Less ‘Intimidating’

Startups and established players alike have been working out payments applications for distributed-ledger technology for several years, and on Thursday one of those applications went commercial. San Francisco-based Wyre, founded in 2013, launched its cross-border payments service based on the blockchain. On the same day, Wyre also raised $5.8 million in a …

Read More »Google Wallet Gets New Browser Capability and Moves Beyond Mobile Devices

Alphabet Inc.’s Google unit has updated its Google Wallet to enable the person-to-person payments service to work on desktop computers and laptops using any browser. Google Wallet dates back to 2011 as a mobile-payments and P2P service, but in September 2015 Alphabet transferred the purchasing functionality to its Android Pay …

Read More »Holiday E-Commerce Spending Grows 12% So Far This Year, Reflecting Confident Shoppers

Consumers are making their shopping, and payments, preferences known this holiday season. They are spending 12% more on e-commerce purchases so far this shopping season than they did in 2015, reports comScore Inc. Consumers have made $49.3 billion in e-commerce purchases from Nov. 1 to Dec. 12 using a desktop computer at home …

Read More »