Adyen Inc. has become the first third-party processor to offer Block Inc.’s Cash App mobile wallet to merchants. The news comes hard on the heels of reports earlier this month that Block had opened its Cash App wallet for payments to e-commerce merchants outside the Square seller network. Square is a unit of Block.

In addition to accepting Cash App as a payment option, Adyen merchants will have access to Cash App’s 80 million users who access the app at least once a year, a number that accounts for one-third of Millennial and Gen Z consumers in the United States, according to Adyen. Millennials and Gen Zers are two fast-growing demographics for merchants and are projected to make up 72% of the world’s workforce by 2029, up from 52% in 2019, according to professional-service firm MarshMcLennan.

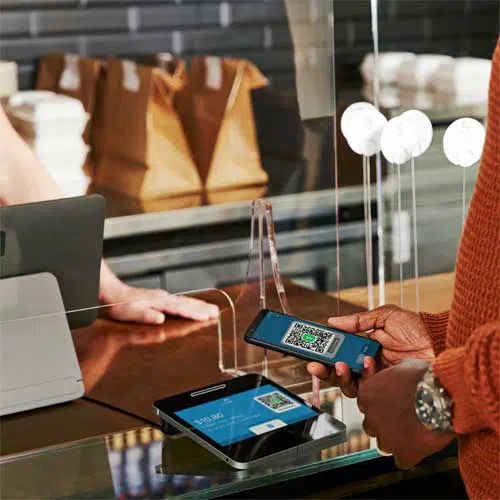

With their growing economic power, Millennials and Gen Zers have shown a preference for contactless payments as offered through wallets such as Cash App falls, according to payments experts. Both groups are increasingly adopting mobile wallets for payments. In February 2021, 65% of young Millennials were using a mobile wallet, compared to 59% in April 2020, according research by processor FIS Inc.. In addition, 57% of Gen Zer’s were using mobile wallets, up from 50% in 2020.

Besides payments to merchants, Cash App allows users to make peer-to-peer payments and to trade in Bitcoin and equities. With these features, “Cash App is a product that fits Millennials and Gen Zers especially well,” says Thad Peterson, a strategic advisor at Aite-Novarica Group, a Boston-based consulting firm.

Cash App’s plan to harness outside merchant processors to expand beyond Square’s own network is also an example of how alternative-payment options are becoming more popular with consumers overall, adding to pressure on merchants to offer them, Peterson adds. Cash App generated $2.6 billion in revenue for Block in the June quarter, of which Bitcoin trading accounted for $1.8 billion.

As for Adyen, Cash App acceptance is seen as a key to pleasing merchants. “At Adyen, we are consistently adding new payment methods to ensure our businesses can meet their end customers where they are,” said Roelant Prins, chief commercial officer for Adyen says in a prepared statement. “We are thrilled to be entering this strong partnership with the Cash App team. We’re looking forward to seeing how we can continue to partner to better service businesses and their customers.”