In testing now, the Abrigo Fraud Detection platform is incorporating artificial intelligence into check inspection and image analysis to help banks manage check fraud.

Though checks written fell from 15.5 billion in 2018 to 12 billion in 2021, according to the 2022 Federal Reserve Payments Study, they remain a significant component of payments, especially for business-to-business commerce.

Austin, Texas-based Abrigo says there is a need for advanced fraud detection for check payments, citing reports that 81% of businesses continue to pay other firms with paper checks and that check fraud is on the rise. “The battle against check fraud is a race against evolving criminal tactics,” Becki LaPorte, Datos Insights strategic advisor, said in a statement.

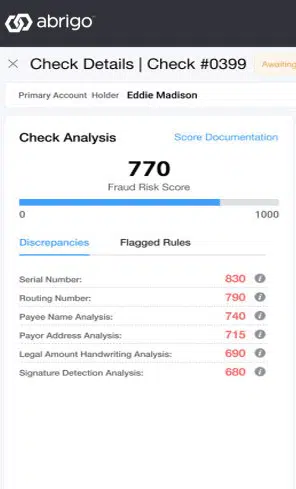

The Abrigo Fraud Detection platform relies in part on Check Fraud Defender technology, which is a nationwide consortium of check-fraud data, AI and machine learning image analysis, and Abrigo’s fraud-decision engine from Mitek Systems Inc. The new platform automates, processes, and smooths workflows.

In testing at a Southeastern U.S. bank, Abrigo Fraud Detection identified 93% of the bank’s total fraudulent check value, or more than $330,000 in potential fraud-loss avoidance.

Abrigo Fraud Detection launched this week with check-fraud detection, and eventually will expand to other transaction types, including wire and FedNow throughout 2024, Abrigo says.