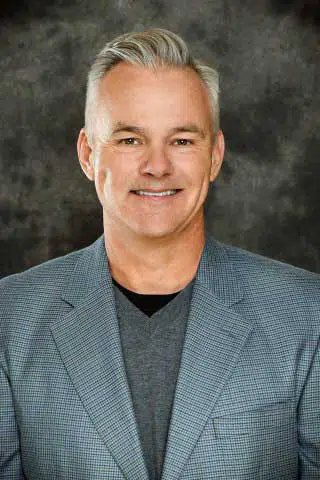

Green Dot Corp. chief executive Dan Henry has only been on the job for about six weeks, but on Monday he was emphatic about one thing: The prepaid card and payments specialist is going to hold on to one particular and—in the view of Henry—very valuable asset. “We are not selling the bank,” he told equity analysts before any of them could pose a question during a call to discuss the company’s first-quarter results.

The Provo, Utah-based institution, which Green Dot acquired in 2010, offers the company a key advantage over the recently emerged challenger banks, Henry argued. “Why would we consider selling it?” he asked. “It is a strategic asset, a source of great potential value.” That value, he added, lies chiefly in the fact that Green Dot Bank gives the company flexibility in the financial products it can offer its core customers—low-to-moderate-income consumers. By contrast, competing challenger banks, typically startups offering a limited array of financial products, are “really just marketing companies,” he contended.

But Green Dot’s new top executive also said much more can be done with the company’s banking assets to ward off new rivals. Henry built his reputation with Netspend, a prepaid card specialist he sold in 2013 for $1.4 billion in cash to Total System Services Inc., now part of Global Payments Inc. “The reason we’re seeing challenger banks pop up is that Green Dot squandered its advantage,” he told the analysts.

The specifics of how Green Dot will further leverage its bank will emerge next year. The company will spend much of 2020 “preparing for 2021,” Henry said. A key part of that plan was announced earlier, though, with the hiring of Daniel Eckert, who left Walmart Inc. in March after 10 years running digital services for the massive retailer. Eckert’s position at Green Dot is chief product, strategy and development officer. “We have some great people but I wanted to add a few more,” Henry said. “The first is Daniel Eckert.”

One of Eckert’s top priorities will be liaison with major Green Dot clients like Apple Inc. and Uber Technologies Inc., as well as Walmart. The key to those relationships is Green Dot’s banking-as-a-service, or BaaS, model, which took the company well beyond its roots in prepaid processing and into services like direct deposit. “One of [Eckert’s] main responsibilities is going to be the BaaS business,” Henry said.

So wrapped up is this strategy with Green Dot Bank that Henry interrupted an analyst at one point to make it clear once again how pivotal that institution is. “Ask as many times as you want,” he told the analyst. “We’re not going to sell the bank.”

Henry succeeded interim CEO William Jacobs, who had taken the reins in January upon the retirement of founder Steve Streit. The company, which celebrated its 20th anniversary in 2019, saw its shares plunge last year by more than two-thirds, settling into the mid-twenties a week before Christmas. They were selling for $30.70 at Monday’s close.

Revenue for the quarter came to $362.2 million, up 6.5% year-over-year. Operating income fell from $81.4 million to $58.8 million. The Covid-19 crisis impacted the company as foot traffic in its retail partners’ stores fell, but its online business “has remained strong,” reported chief financial officer Jess Unruh.