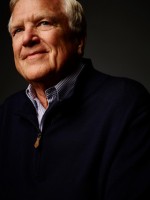

Having built a successful payments processor and sold it to Global Payments Inc., Bob Carr is ready to build another company, but this time with a purpose beyond simply making money.

Carr’s latest endeavor is Beyond, launched May 1, just over a year from the closing of Global Payments’ $4.3 billion acquisition of Heartland Payment Systems Inc. In addition to providing payment-processing services, Beyond’s product lineup includes point-of-sale, lending, vending, and integrated human-resources tools. Integrated payments products are available, too.

Carr expects Beyond to process its first transactions in June. He’s mum on the processors the company is working with.

The motivation to launch Beyond stems from more than Carr’s entrepreneurial inclination. It also results from his desire to secure long-term funding for the Give Something Back Foundation Inc. The foundation is the beneficiary of his personal earnings and majority shareholder position in Beyond.

The foundation, which started in 2003 to grant scholarships to high-school seniors who were good students but financially needy, has evolved. Carr says the emphasis now is on helping children of incarcerated mothers. “The child of an incarcerated mother has one-tenth of the chance of going college [compared to] the child of an incarcerated father,” Carr tells Digital Transactions News. “A lot of kids are used to growing up without the father in the home,” he says. The absence of the mother, however, is less common and more impactful. Youth leaving foster homes and homeless students also are eligible for Give Something Back scholarships.

To date, the foundation has awarded more than $35 million to more than 1,500 students. The program initially was available only to students in Illinois, but has expanded in the past two years to seven states.

As for Beyond, Carr is using many techniques and practices he found valuable at Heartland. Chief among them is a preference for employees and not independent sales agents to market to merchants. “It works,” Carr says of the employment model. “It allows employees to be entrepreneurial within an entrepreneurial company.”

Uniquely, Beyond is applying a twist to the model. Hires can invest in the company and gain an equivalent ownership stake in Beyond, Carr says. Though investment is not a requirement of employment, the opportunity is being extended to all hires. Beyond has plenty of capital, Carr says, and has no private-equity backers.

Some of Beyond’s employees worked with Carr at Heartland, but found themselves ready for Beyond following the Global Payments acquisition. “Many of the Heartland executives were terminated,” Carr said. “Many of them and the salespeople are coming back.”

Carr is in the midst of a big recruiting drive and anticipates a lot of conversations at the Electronic Transactions Association’s Transact17 conference this week in Las Vegas.

Currently, Beyond has 43 employees. It is just starting to hire sales staff, Carr says. He expects to hire 30 employees in May with another group joining in June. Ideally, candidates will have sales experience and integrity, he says.

Not all merchant-services companies use the employee model for its salespeople. “Some of our competitors think we overpay our salespeople,” Carr says. But those using independent agents may go out and pay a multiple of the revenue to buy a portfolio, and are unwilling to compensate the salesperson generating the merchant accounts with an equity stake, he says. “We just pay the salesperson more for the account than most of our competitors do.”

That approach, which Carr long championed at Heartland and industrywide, is part of Beyond, too. Heartland advertised the “Merchant Bill of Rights,” a set of principles, such as the right to know the fee for each card transaction and who’s charging it, as a way to counter some of the negative perceptions merchants may have of the payment-processing industry. Beyond also makes its set of 10 “Beyond Promises” prominent, such as not imposing surcharges and disclosing all card transaction fees and who is charging them. “The Beyond Promises are religion to us,” Carr says.

Though some parts of Beyond may mirror Heartland, strategically it will target additional merchant types, Carr says. Beyond will focus on nonprofit organizations, restaurants, and dealerships, such as recreational vehicle dealers, he says.