A report that Bank of America Corp. might not renew its joint merchant-acquiring venture with leading payment processor First Data Corp. left observers wondering Thursday what the break-up of one of the payments industry’s biggest players would mean for the companies involved, and the wider industry. The joint venture, Bank …

Read More »ACI Acquires Western Union’s Walletron Mobile Bill-Presentment Business

In an effort to boost its electronic bill-payment offerings, payments-technology provider ACI Worldwide Inc. on Thursday announced its second recent acquisition from The Western Union Co., this one of mobile bill-presentment provider Walletron Inc. Today’s announcement came at the same time Naples, Fla.-based ACI said it will complete its previously …

Read More »Account-Validation Requirement Coming to ACH Internet Payments

An automated clearing house network rule tightening security around Internet purchases, one of the ACH’s fastest-growing transaction categories, is set to take effect Jan. 1. The rule change, technically an amendment, affects so-called WEB debits, which cover a wide variety of ACH-funded Internet payments. It will require merchants as ACH …

Read More »The Fed Says an Announcement About Operating a Real-Time Payment System Is a Ways Off

Will it or won’t it? Those eagerly awaiting word about whether the Federal Reserve will directly operate a real-time gross settlement system will have to wait a bit longer. The Fed last October said it was considering whether to directly develop and operate a RTGS system as an outgrowth of …

Read More »Mastercard Adds To Its Bill-Pay Heft With Transactis Acquisition

In its latest move to enhance its electronic bill-payment services, Mastercard Inc. announced Friday it has a deal to acquire bill-pay platform provider Transactis Inc. New York City-based Transactis provides technology that enables small businesses and organizations such as schools and property owners that mostly deal with paper bills and …

Read More »Denver Transit Riders Can Now Use Uber To Buy Tickets

Denver light-rail and bus riders will be making a bit of electronic-payments history this spring and summer by being the world’s first commuters able to use Uber Technologies Inc.’s mobile app to buy and use transit tickets. The new service, which will be rolled out over the next few weeks, …

Read More »Global Payments Touts Differentiated Strategy as Worldpay Reports Strong First-Quarter Results

The big merchant processors Global Payments Inc. and merger candidate Worldpay Inc. reported healthy first-quarter results Thursday. North America performed especially well for Atlanta-based Global Payments, generating $678.4 million in revenues, up 14% from $594 million in 2018’s first quarter. In contrast, European revenues slipped 0.3% to $142.9 million while …

Read More »Square’s Dorsey Not Troubled by the Acquiring Industry’s Mega-Mergers

Square Inc. has been a non-traditional merchant acquirer since its birth nearly a decade ago, and a wave of industry mergers won’t change that, according to chief executive Jack Dorsey. “I do think we will continue to see consolidation, but that doesn’t worry me,” Dorsey, who also is Twitter Inc.’s …

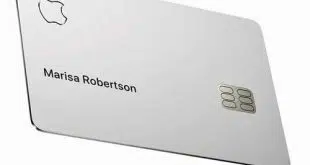

Read More »Apple Pay on Track To Hit 10 Billion Transactions in 2019

Boosted in part by transit systems and other merchants adopting contactless payments, the Apple Pay mobile-payments service had another quarter of record volume and is heading for a milestone this year, Apple Inc. chief executive Tim Cook said Tuesday. “Apple Pay transaction volume more than doubled year-over-year, and we are …

Read More »Mastercard Will Remain on the Hunt for Acquisitions and Fintech Investments, Its CEO Says

Mastercard Inc. has been active on the mergers-and-acquisitions front lately, and that’s going to continue, according to company president and chief executive Ajay Banga. The acquisitions typically involve financial-technology firms in all corners of payments. Just two weeks ago, Mastercard announced that it had acquired Vyze Inc., the provider of …

Read More »