Taking a page from Square Inc.’s playbook, PayPal Holdings Inc.’s Venmo peer-to-peer payments service is testing what it calls Venmo Business Profiles, a potentially revenue-generating service that enables Venmo users who are sole proprietors of small businesses to sell goods through an affiliated page visible to other Venmo users.

Announced Wednesday, the service is being offered by invitation only to a “limited number” of users, Venmo said in a blog post. Venmo, whose P2P service has social-network aspects, seems to be courting the same legions of part-time sellers and small-business owners who formed Square’s original merchant base a decade ago.

“Business Profiles allows sole proprietors, casual sellers, and users with a side hustle to create an additional Venmo profile to accept payments for goods and services,” the post says. “Whether you’re an artist, selling homemade planters at a craft fair, serving up one-of-a-kind haircuts, selling floral arrangements or mowing lawns, you can now leverage the power of Venmo’s community of more than 52 million users to generate interest, referrals and awareness for your business.”

That user count is up from 40 million just over a year ago. Venmo processed more than $31 billion in total payment volume in the first quarter, up 48%, according to PayPal’s latest financial report.

For payment, Business Profiles sellers can print a Quick Response code that customers can scan with their mobile phones at the point of sale. Or they can send a QR code to the customer by text or email, or through Apple Inc.’s AirDrop service; the code links to the merchant’s Venmo business profile.

A spokesperson for San Jose, Calif.-based PayPal declined to answer Digital Transactions News’s questions about the service, instead referencing the blog and a frequently asked questions post.

Merchant pricing is free now, but when the no-cost period ends at an unspecified time pricing will be 1.9% of the sale plus 10 cents. Standard Venmo fees also apply to sellers and customers, but Venmo users who make a payment to a business profile will a credit card will be exempt from Venmo’s 3% fee on payments funded by credit cards.

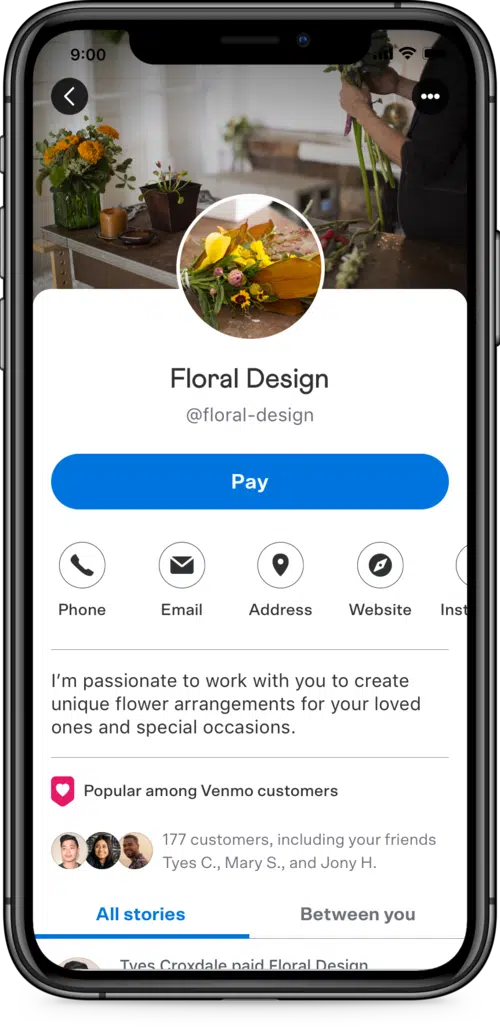

Venmo Business Profiles currently is available only to sellers using Apple’s iOS mobile devices, but it will be available for Android devices in the coming weeks, Venmo said. Invitees will see a “Create Business Profile” or similar notice in the Venmo app. It then asks the user to provide a photo for the business profile, business name and user name different from his or her personal Venmo profile, business description and primary business category, contact methods, and business address.

PayPal for several years now has been working to “monetize” Venmo, whose basic P2P service is free. Revenue-generating affiliated services include instant transfers, a Venmo Mastercard debit card, and Pay With Venmo, a fee-generating service that lets users tap their Venmo balance at the point of sale. In the pipeline is a Visa credit card issued by Synchrony Financial.

“This appears to be a logical extension of Venmo’s earlier move into commerce, and it allows their user base to leverage existing Venmo relationships and potential customers with a user-friendly, well-known interface,” e-commerce researcher Thad Peterson, a senior analyst at Boston-based Aite Group LLC, tells Digital Transactions News by email. “It would be particularly useful for individuals working freelance or in the gig economy, where separating business and personal expenses is important. It may be more competitive with the payment schemes evolving on the Facebook and other social media platforms than with Square’s more traditional approach to payments and POS.”