Paze, the upcoming digital wallet backed by banks, has lined up an integration with Endava plc, a software-development firm.

Announced Wednesday, the integration, which will be available when Paze launches in 2024, means merchants that use Endava can offer the Paze online checkout. London-based Endava says the simplified checkout will include support for more than 150 million payment cards.

Paze is under development by Early Warning Services LLC, the creator of the Zelle person-to-person payments wallet. With the backing of seven large banks that also are owners of Early Warning, the Paze wallet will be populated with 150 million cards from the start and will need only to be activated by the cardholders for use.

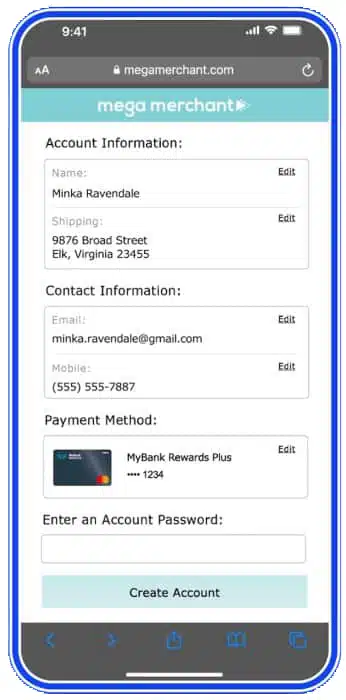

Because the participating issuing banks—all Mastercard Inc. or Visa Inc. issuers in the United States—already have established relationships with consumers through their card products, card data and billing-address information will be available in Paze without the consumer having to type anything but the email address associated with the card account.

Paze previously announced Web-services provider GoDaddy Inc. is testing Paze with some of its merchants.

Consumers will be able to add different shipping addresses and store them in Paze, too. The wallet also features a card updater capability. In addition, the issuer can send a notice in the Paze wallet asking the consumer to update an expired card, after verification with a one-time password and after supplying a card-security code.

Paze is one example of the accelerated-checkout trend in e-commerce. This notion implies much of the checkout data—billing and shipping addresses and related information—already is complete when the consumers goes to a checkout page, thereby accelerating the purchase process.

“Manual card entry at guest checkout must become a thing of the past,” James Anderson, Paze managing director, told Digital Transactions for a story in the magazine’s December issue. “Unfortunately, it’s still very much an option that consumers end up using, despite the fact it is loaded with friction. It forces consumers to have their physical card close by and leaves room for errors. It also relies on static data. which is intrinsically less secure.”