Digital bill payment has become table stakes for billers as consumers have increasingly gravitated toward paying their bills through mobile and online channels the past two years, according to a recent survey by EngageSmart, a provider of a customer-engagement and payment applications.

The study reveals that 50% of respondents say they are somewhat or significantly more likely to pay their bills digitally now than before the Covid-19 pandemic, while 46% of the remaining respondents say they make digital bill payments as often as they did prior to the pandemic. Only 4% of respondents say they are less likely to make digital bill payments.

Health care has seen rapid growth in the adoption of digital bill payment, with 42% of respondents paying their bill digitally in 2022, compared to 31% in 2020. Taxes are another bill consumers are digitally paying with more frequency, with 32% of respondents paying digitally in 2022, compared to 25% in 2020.

Other bills consumers regularly pay digitally include Internet service and credit cards, with 64% and 66% of respondents, respectively, saying they pay those bills digitally. In 2020, 62% and 60% of respondents said they digitally paid their Internet and credit card bills, respectively. EngageSmart, which conducts the survey annually, surveyed more than 2,100 consumers that use its InvoiceCloud bill-payment service.

“Consumers are now used to going online first for everything from shopping to booking concert tickets, restaurant reservations, and medical appointments, and digital payments have been proven to be just as secure and convenient as using a credit card in person or online,” Sara Faied, vice president of processing transformation for InvoiceCloud, says by email. “Consumer choice is also a big factor, as there were only a few digital-payment options available just a few years ago as compared to today, which also has helped adoption of digital bill payment.”

One surprise in the findings is that bill payments initiated through mobile devices have exceeded bills paid digitally through online portals. In 2022, 67% of respondents say they made a bill payment via mobile device compared to 63% who said they made a bill payment through an online portal (more than one choice was possible). Mobile devices are also consumers’ preferred device type for digital bill payment, with 30% of respondents saying they favor mobile devices, compared to 28% for online portals.

Convenience is the driving force behind consumers’ preference for using a mobile device, according to Faied. “It doesn’t get more convenient than a computer you can carry around in your pocket [to pay a bill]. It’s worth noting that while the vast majority of respondents (92%) took the survey on their phone, only 30% say mobile devices are their preferred method for making a bill payment,” Faied says. “Payers may be comfortable using their mobile phones for many things, but there’s clearly still room to optimize the mobile-payment experience.”

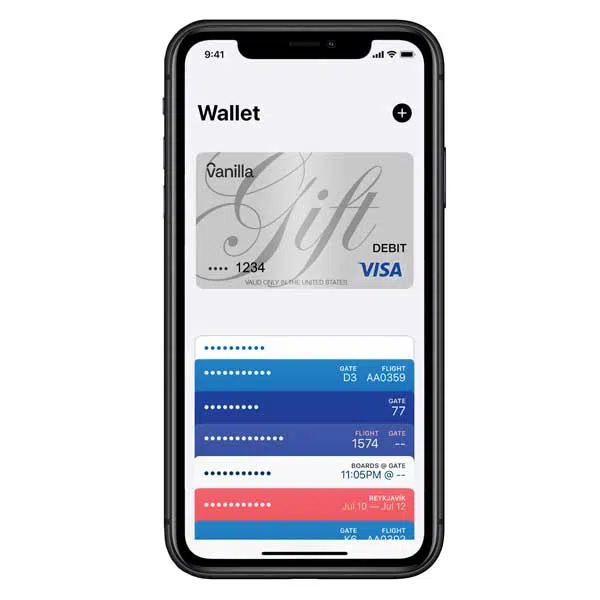

When it comes to mobile wallets, Apple Pay tops the list in terms of popularity, with 53% of respondents saying they prefer using Apple Pay over other digital-wallet options. PayPal, which ranks second overall, is most preferred by respondents over age 60, which the report says is notable considering this age group lags in mobile-wallet adoption.

“Apple is known for simple, elegant, secure solutions, and I think that applies here,” says Faied, who adds consumers can also use Apple Pay through their Apple Watch. “Apple Pay is safe and easy to use, and it has enabled a lot of people to feel comfortable leaving their wallet behind as long as they have their mobile device with them.”

One pain point when it comes to digital bill payment is that it can be difficult for consumers to contact customer service. This hurdle was cited as the most common problem by consumers age 30 and above.

“The more difficult the online-payment experience, the more likely customers are to call a billers’ office or abandon payment altogether,” Faied says. “If customer-service teams are tied up trying to help confused customers complete a payment over the phone, they will be much more difficult to contact for any issue.”