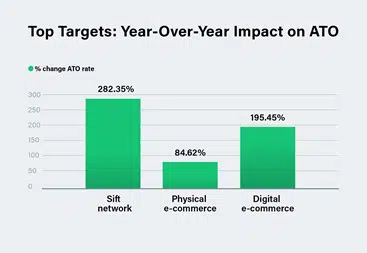

Account takeover fraud has been a challenge for e-commerce merchants since business online. But recent years have proven exactly how pervasive ATO is across every industry, and revealed that it’s the average fraudster’s weapon of choice. Between the second quarter of 2019 and Q2 2020, overall ATO rates (the percentage of total logins that were stopped because they were fraudulent) surged by 282% across the entire Sift global network of merchants.

Digital and physical e-commerce were hit especially hard compared to other verticals. Combined with 2020’s heavily disrupted economy, this massive spike has put risk teams in a difficult position. Predictions are no longer reliable; patterns are unpredictable. And this year, trust and safety experts are without the fraud-fighting tools and data they usually depend on.

The Creeping Cost of Account Takeover

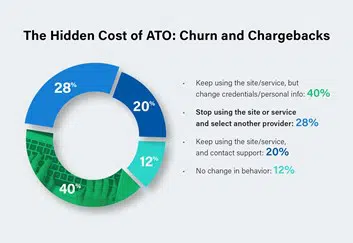

A more urgent issue for merchants is the growing evidence that account takeover fraud can capsize businesses from the outside in, causing lasting damage that goes well beyond a fraudster’s immediate control. Consumers reported that, if an account they owned were hacked, almost one-third of respondents said they’d stop using the impacted site or service and turn to a direct competitor.

Losing 28% of one-time customers is a huge problem on its own. But if businesses consider the average customer’s lifetime value (LTV), or how customer acquisition costs (CAC) are impacted by brand abandonment, the consequences of account takeover get exponentially bigger—and even the most accurate data doesn’t account for the consequences of negative reviews and a company reputation blighted by fraud.

The latest industry report from Sift, Digital Trust & Safety Index: Account Takeover Fraud and the Growing Burden on Business, explores the story behind these findings. With insights derived from Sift’s global merchant network of over 34,000 sites and apps across e-commerce, in addition to a survey of 1,000+ consumers, this newly-released report gives online merchants an understanding of why, how, and when ATO can cause significant disruption to a business. From user expectations around data security to account takeover’s impact on buying behavior, this report digs into how fraudsters exploit security loopholes, which verticals are under attack from opportunistic fraudsters, and how trust and safety experts can effectively stop account takeover fraud in pandemic-era e-commerce.