Global Payments Inc. will roll out its revamped Genius point-of-sale package of products and services domestically in May as a common brand, with an international rollout late this year, chief executive Cameron Bready assured listeners on a conference call early Thursday. A major repositioning of the Atlanta-based company’s acquiring technology, …

February, 2025

-

13 February

Stripe Teams With Spade on Data Tool for Issuers

Stripe Inc. announced late Wednesday it is partnering with Spade, a provider of real-time merchant intelligence for card issuers, to provide issuers on the Stripe platform with data to verify a merchant’s identity during the authorization process. Spade provides information such as merchant name, category, and geolocation within 50 milliseconds. …

-

12 February

Eye on Travel: Cruise Line Gets Onboard With PayPal; Worldline And Freedom Eye Travel Expansion

It may be the midst of winter, but some payment companies are preparing for the travel season. Travelers booking passage on a Norwegian Cruise Line ship can now use their PayPal Holdings Inc. digital wallet to pay for their cruises. PayPal says the payment option is available for trips with …

-

11 February

Worldpay Is Doing Well, But It’s Not a ‘Growth Driver’ for FIS, Execs Say

Top executives at FIS Inc. early Tuesday reported accelerating revenue in 2024 and see that momentum carrying into the new year, but the energy appears to be coming from financial technologies apart from the big Worldpay merchant-processing platform. “Worldpay has not been a growth driver in 2024, and won’t be …

-

11 February

Paysafe Offloads Part of its Business and other Digital Transactions News briefs from 2/11/25

Paysafe Ltd. has agreed to sell its direct marketing payment processing business, including reseller and merchant contracts, to Kort Payments, a company run by Joel Leonoff, Paysafe’s founder and former chief executive. Terms were not announced. Paysafe said this business “consists of direct marketing and other card-not-present volume in both complex …

-

10 February

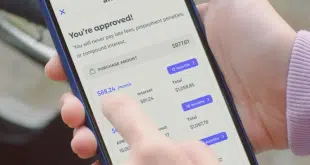

Eye on BNPL: Affirm’s Toothy Win; Gateway Adds Klarna Integration

Coast Dental, a dental practice with 100 locations in Florida, Georgia, and Texas, added Affirm’s buy now, pay later payment options. In related news, Decta Ltd., a United Kingdom-based fintech, has integrated Klarna AB’s BNPL service into its white-label payment gateway. Tampa, Fla.-based Coast Dental says the Affirm payment option …

-

7 February

Paysafe’s Shares Climb As Wall Street Buzzes With Takeover Talk

Paysafe Ltd., one of the world’s largest payments processors, has developed a highly sophisticated stake in online gaming, but lately the odds may favor a change in ownership for the publicly held London-based company, according to industry speculation. News emerged late Thursday that the company’s current valuation–$1.4 billion, down from …

-

7 February

Judge Grants More Banks Relief from Illinois Interchange Law, But Stops Short of Going All the Way

U.S. District Court Judge Virginia Kendell extended the injunction against Illinois’s pending interchange law late Thursday to include more financial institutions but stopped short of providing blanket relief from the law for all financial institutions and the card networks. Kendall, a judge in the Northern District of Illinois, ruled that …

-

7 February

Affirm Revenue up 47% and other Digital Transactions News briefs from 2/7/25

Buy now, pay later specialist Affirm Holdings Inc. reported $866.4 million in revenue for its fiscal second quarter ending Dec. 31, up 46.4% from $591.1 million in the year prior quarter. With a profit of $80.4 million, Affirm reversed last year’s quarterly loss of $166.9 million. Among other metrics for the quarter, …

-

6 February

Evolv Partners With United Bankers Bank, While Deluxe Posts 2024 Earnings

Evolv Inc. has partnered with United Bankers Bank to provide a merchant-services program to UBB’s community-bank customers. The deal is expected to advance innovative payment solutions across the financial institutions served by United Bakers Bank, according to Evolv and UBB. The services will make up a “concierge-style, white-glove” merchant-services program …