• Juniper Research released a study estimating retailers globally will sustain $71 billion in card-not-present fraud over the next five years. The firm cites the U.S. move to EMV and “delays” in the arrival of the 3D Secure 2.0 protocol among the reasons for the forecasted losses. • Michael S. Blume, …

June, 2017

-

20 June

Hackers Find Fertile Ground in North America and in Stores, Trustwave Reports

By Jim Daly@DTPaymentNews North America remains by far the source of most data breaches investigated by Trustwave Holdings Inc., a big security-services and technology provider that operates worldwide, and the retail industry takes the lead in breaches despite the coming of EMV chip card payments to the U.S. Those are …

-

20 June

Eyeing Hotter P2P Competition, PayPal Enables Instant Transfers to Users’ Bank Accounts

By John Stewart@DTPaymentNews PayPal Holdings Inc. on Tuesday cranked up the heat on a person-to-person payments market that’s already close to full boil. In a blog post on PayPal’s site, PayPal chief operating officer Bill Ready announced the company has started testing instant transfers from users’ PayPal wallets to their …

-

19 June

COMMENTARY: Is Open Banking the Beginning of the End for Payment Networks?

By Rick Oglesby and Brad Margol A 2015 European Parliament regulation, EU2015/751, caps the fees that a European cardholder’s bank may charge a merchant’s bank (interchange fees) at 0.2% for debit cards and 0.3% for credit cards. Also passed in 2015, and ramping up to full effect in January of …

-

19 June

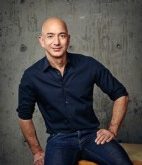

With Its Deal for Whole Foods, Amazon Could Usher in Seismic Change for the Checkout

By John Stewart @DTPaymentNews If Amazon.com Inc.’s $13.7 billion acquisition of Whole Foods Market Inc. closes later this year as expected, it could set the stage for a radical redefinition not just of in-store payments, but of the checkout experience itself, observers say. The deal, which Amazon announced late last …

-

19 June

Chargebacks Tied to EMV Transition and other Digital Transactions News briefs

• PNC Bank N.A. said its Visa commercial cardholders can use their cards in Apple Pay and Samsung Pay, a move that PNC said makes it one of the first U.S. banks to enable mobile wallet payments for its commercial cards. • A survey from Vesta Corp. found that 62% of 155 …

-

19 June

Apple Makes an Offers Ploy To Drive Apple Pay Use

By Kevin Woodward@DTPaymentNews Apple Inc. is sponsoring its first known offers promotion for Apple Pay users with deals available June 23-25 in two San Francisco neighborhoods. Dubbed “Lose your wallet” on Apple’s Web site, the promotion includes a percentage off the purchase or a free item with a purchase. The …

-

18 June

MOBILE ORDERING: CASHING IN ON CONVENIENCE

It’s no secret that smartphones and other mobile devices are changing every aspect of our lives – not only how we connect with each other digitally, but even how we buy products offline. This creates opportunities for savvy merchants – and the payments agents that serve them. Today, consumers …

-

16 June

As SIM-Swapping Fuels Account Takeovers, Payfone Patents Tech to Fight It

Consumers may not realize it, but their mobile phone is a gateway for criminals to take over their bank accounts. In a fast-growing scam known as SIM swapping, criminals transfer the phone number associated with a consumer’s mobile phone to the SIM card embedded in a mobile phone in their …

-

16 June

CFPB Considers Another Prepaid Rule Delay and other Digital Transactions News briefs

• The Consumer Financial Protection Bureau has issued a proposal adjusting certain provisions of its massive rule for prepaid accounts and asking for comment on whether the effective date for the rule should be delayed a second time. The proposed adjustments concern requirements for error resolution on unregistered accounts and wider flexibility for credit …