Fitbit Inc. said its smart watches and trackers with Fitbit Pay can be used to pay for transportation on seven major transit systems globally, as well as on the contactless OMNY system set for launch May 31 by the Metropolitan Transportation Authority in New York City. Multiple law firms are …

May, 2019

-

28 May

The Global-TSYS Merger Responds to M&A Mania But Also Integrated Payments Trends

Facing major consolidation among rival processors. Global Payments Inc. and Total System Services Inc. (TSYS) made it official Tuesday they are merging in an all-stock deal that values TSYS at $21.5 billion and will leave Global with 52% of the combined entity. The acquisition is expected to close in the …

-

28 May

COMMENTARY: Why Visa And Mastercard Have Been on a Buying Spree

Amazon, Apple, and Microsoft each briefly enjoyed a market capitalization greater than $1 trillion. The two dominant global payment networks, Mastercard and Visa, aspire to join this august, and for the moment, memberless club. In the near term, the networks could grow on autopilot. However, inevitably diminishing retail-payments growth in …

-

28 May

Nuvei Buying SafeCharge and other Digital Transactions News briefs from 5/28/19

Payments provider Nuvei announced it will buy SafeCharge International Group Ltd. for approximately $889 million. SafeCharge’s payment platform provides services ranging from card acquiring and issuing to processing and checkout. This confirms reports of a pending deal. Processor Payment Data Systems Inc. said Dealer Pay LLC, provider of a payments …

-

24 May

Another Major Deal Could Be on the Horizon As News Emerges of TSYS-Global Payments Talks

A potential merger, joint venture, or partnership may be in the offing for Global Payments Inc. and Total System Services Inc. (TSYS). The two merchant-processing powerhouses have held preliminary discussions about a combination of some sort, according to a report late Thursday by Bloomberg.com. In addition to traditional merchant processing, …

-

24 May

An Operation Choke Point Settlement and other Digital Transactions News briefs from 5/24/19

The Electronic Transactions Association sent letters to Congress and the Canadian Parliament urging lawmakers to ratify the pending U.S.-Mexico-Canada trade agreement (USMCA) that would replace the North American Free Trade Agreement. Among other things, the USMCA reflects “the importance of data, technology, and innovation,” and would bar any country from …

-

23 May

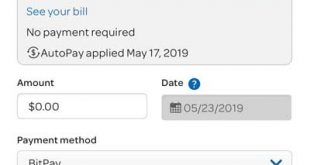

AT&T Says It’s Now the First Mobile Carrier to Accept Cryptocurrency for Bill Payments

AT&T Communications said on Thursday that starting now it will accept bill payment in cryptocurrency, making it the first mobile carrier, and one of the largest companies overall, to do so. The company, a unit of AT&T Inc., is using Atlanta-based processor BitPay Inc. to handle digital-currency payments. No information …

-

23 May

Payday Lenders Settle Operation Choke Point Lawsuit Against Federal Bank Regulators

A five-year-old lawsuit brought by payday lenders against federal banking regulators over the government’s controversial Operation Choke Point ended with a settlement this week. Advance America, Cash Advance Centers Inc. (Advance America), and Check Into Cash had sued the Federal Deposit Insurance Corp. and the Office of the Comptroller of …

-

23 May

Issuers And Networks Line up for New York’s Contactless Mass-Transit System

There’s nothing like mass transit to inculcate payment habits in consumers, so it’s no surprise the major card brands are scrambling to see that their products are part of the ongoing rollout of contactless payments in the nation’s biggest transit system, New York City’s Metropolitan Transportation Authority. Starting May 31, …

-

23 May

Attacks From Rogue Mobile Apps Jump 300%, and CNP Fraud Continues To Boom, RSA Finds

Fraud attacks involving rogue mobile applications jumped nearly 300% in the first quarter from the preceding quarter, and fraudulent card-not-present transactions rose 17%, fraud-control services provider RSA Security says in a new report. Bedford, Mass.-based RSA says it flagged 41,313 attacks from rogue apps compared with 10,390 in 2018’s fourth …