Unlike the case with previous changes in consumer payment behavior that took years, if not decades, the Covid-19 pandemic has accelerated adoption of touchless payments, as more and more consumers look for hygienically safer and convenient ways to pay, says a Fiserv Inc. report released Friday. The report surveyed 1,037 consumers …

October, 2020

-

26 October

USAT Completes EMV Advance and other Digital Transactions News briefs from 10/26/20

USA Technologies Inc., a payments-technology provider for the vending-machine business, announced it has completed the introduction of EMV and contactless EMV acceptance capability for its ePort G10-Chip reader line. The enhancement process was launched in February.The Western Union Co. said it now has added bank accounts, wallets, and cards to its …

-

23 October

ExxonMobil Deploys QR Codes And NFC Tags for Streamlined Mobile Payment at the Pump

Petroleum giant ExxonMobil Corp. is adding QR code and near-field communication-enabled tags to its fuel pumps for consumers using Apple Pay or Google Pay. ExxonMobil says more than 11,500 U.S. Exxon and Mobil stations will have the tags by year’s end. Users can hold their iPhones or Android phones against …

-

23 October

‘We Hope the Worst Is Behind Us’ Says AmEx’s Boss As the Company Shows Signs of a Comeback

As the economy registers a tentative recovery from the deep recession caused by Covid-19, payments networks are doing likewise. This is probably no more true than with American Express Co., whose concentration in the travel-and-entertainment market caused the company’s financials to nosedive earlier this year as the pandemic grounded airlines, …

-

23 October

Gmail Gaining Shopping and Purchasing Capabilities and other Digital Transactions News briefs from 10/23/20

Alphabet Inc.’s Google unit announced it is enabling shopping and purchasing within its Gmail email service via an agreement with Skipify Inc., a payments provider that relies on artificial intelligence technology.North Lane Technologies, formerly Wirecard North America Inc., and daVinci Payments have banded together to create Syncapay Inc., a holding company for payment-technology …

-

23 October

COMMENTARY: Why Attrition Is No Longer a Core Metric for Valuing Merchant Portfolios

Strange times. Seemingly overnight, one of the most durable and heavily weighted key performance indicators (KPIs) for the quality and valuation of traditional, brick-and-mortar merchant-acquiring portfolios has lost its salience. Its meaningfulness has gone from a primary driver of value to a mere footnote. Not everyone will agree. But when …

-

22 October

Alliance Data Shifts Its In-House Private-Label Processing Operations to Fiserv

Alliance Data Systems Corp., a provider of loyalty and marketing services, is moving its nearly 24-year-old in-house private-label card processing operations to Fiserv Inc. The move is part of Alliance Data’s strategy of investing in the development of new digital services for its customers, such as offering credit options to …

-

22 October

Instacart Pairs With Aldi for a First-Time Service Offering Grocery Delivery for EBT Users

As Covid-19 cases spike around the country, grocers and technology companies alike are scrambling to blunt the pandemic’s financial impact. On Thursday, the online delivery service Instacart announced it is starting a program with the grocery chain Aldi to allow recipients of federal SNAP benefits to use their electronic benefit …

-

22 October

Discover Volume up 11% and other Digital Transactions News briefs from 10/22/20

Discover Financial Services reported its payment-services volume totaled $69.7 billion in the third quarter, up 11% year-over-year. Volume on the Pulse debit network increased 16% to $55 billion owing to larger average spending due to the pandemic and to the lift from stimulus funds.Payments provider PaymentCloud Inc. said it acquired contactless technology startup …

-

21 October

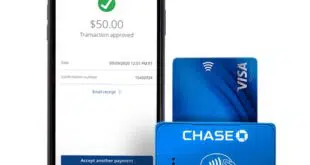

Eye on Acceptance: Visa Rolls Out Tap to Phone; Chase Launches QuickAccept

Visa Inc. on Wednesday announced the rollout in 15 geographic markets of Visa Tap to Phone, which allows consumers to initiate a transaction simply by tapping a contactless card to a merchant’s NFC-enabled mobile device. Tap to Phone is now live in numerous countries throughout Europe, Middle East, Africa, Asia …