The Consumer Financial Protection Bureau late Thursday released a report raising questions about the part restrictions imposed by big technology firms like Apple Inc. and Alphabet Inc’s Google subsidiary may play in hampering innovation, consumer choice, and the growth of open and decentralized banking and payments in the U.S. The …

September, 2023

-

8 September

Commentary: BNPL May Be All the Rage, But Embedded Lending Is a Better Option for Merchants

According to Juniper Research, 360 million people worldwide used Buy Now, Pay Later (BNPL) in 2022. With such an expansive consumer base, BNPL has also become an effective tool for merchants to attract new customers and increase conversion rates. However, the widespread use of BNPL has raised concerns regarding transparency …

-

8 September

Square Outage Disrupts Transactions And Other Digital Transactions News briefs from 9/8/23

Block Inc.’s Square and Cash App units began experiencing system outages late Thursday, according to news reports. Cash App’s outage reportedly affected peer-to-peer payments, cash-ins, and cash card transactions. At Square, engineers reported early Friday they were deploying a solution. Point-of-sale system maker iPOS Systems has enabled Tap to Pay on iPhone for U.S. …

-

7 September

Eye on Fraud: Global Ransomware Attacks Soar to a Monthly High; Cyber Attacks Hit Hospitality Merchants

Monthly global ransomware attacks hit an all-time high in March, totaling 460. That’s a 62% increase from the same period a year earlier, and a 91% increase from the prior month, according to the fall edition of Visa Inc.’s 2023 Biannual Threats Report. Leading causes for ransomware attacks are criminals …

-

7 September

Eye on Cannabis: POSaBIT POS 2.0 Debuts; Organic Payment Gateways’ New Program

Though not as credit and debit card friendly as some industries, the legalized cannabis industry continues to create opportunities for payments companies. Among the latest developments are the release of POSaBIT Systems Corp.’s latest point-of-sale system and a new program from Organic Payment Gateways. Bellevue, Wash.-based POSaBIT says its POSaBIT …

-

7 September

Cantaloupe Volume up 14%And Other Digital Transactions News briefs from 9/7/23

Cantaloupe Inc., a payments provider for the vending and self-service industries, reported it processed $703.5 million in volume in the June quarter, up 14% year-over-year, on 278.6 million transactions, up slightly from 274.6 million. It collected $64.2 million in revenue, an 11% rise. In a letter to shareholders, Innovative Payment Solutions …

-

6 September

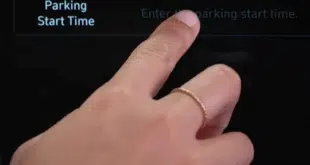

Hyundai Jumps Into In-Car Payments With Hyundai Pay

Hyundai Motor North America has launched Hyundai Pay, an in-car payments app that will enable drivers to find and pay for products and services using stored credit card information and the vehicle’s touchscreen. Hyundai owners will initially be able to use the app to locate, reserve, and pay for parking …

-

6 September

Browns Stadium Opts for Clover Sport Point-of-Sale System

When the Cleveland Browns open their 2023 NFL home stand Sunday, fans at the stadium using credit and debit cards will be tapping and dipping via new Clover Sport devices. Announced Wednesday, the nearly 500-device installation in concession and premium-seating locations in the Cleveland Browns Stadium will make the arena …

-

6 September

Moving Cards from Plastic to Paper And Other Digital Transactions News briefs from 9/6/23

Prepaid card platform Blackhawk Network said it is working with Visa Inc. to convert its Visa-branded cards from plastic to paper-based materials. Payments provider Central Payments released PayCP, its payout platform that initially includes a virtual Discover prepaid card, a physical Discover prepaid card, push to debit cards via Mastercard Send, and ACH bank …

-

5 September

Infinicept Offers Launchpay, a Path for Software Companies to Become a Payfac

Infinicept, a provider of embedded payments, Tuesday introduced Launchpay, a payment facilitator (Payfac)-as-a-service model for software companies not yet ready to become full-scale payment facilitators. Payment facilitators allow customers to accept electronic payments using their platform through a master merchant account. Examples of Payfacs include Block Inc.’s Square merchant-processing unit …